Discover The Latest In Real Estate

Stay in the loop with the latest in local and global real estate. Watch insightful property reviews, explore opportunities in foreign real estate, and check out must-read articles which keep you informed and on track with the ever-evolving world of real estate.

Discover The Latest In Real Estate

Stay in the loop with the latest in local and global real estate. Watch insightful property reviews, explore opportunities in foreign real estate, and check out must-read articles which keep you informed and on track with the ever-evolving world of real estate.

Crestbrick Global

Explore global real estate opportunities

Must Read

Stay informed and inspired with the latest on real estate

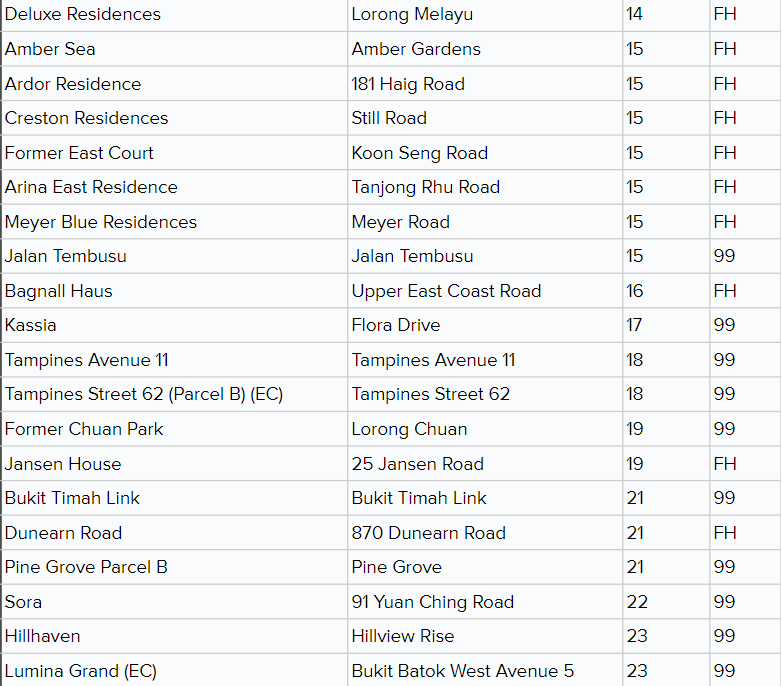

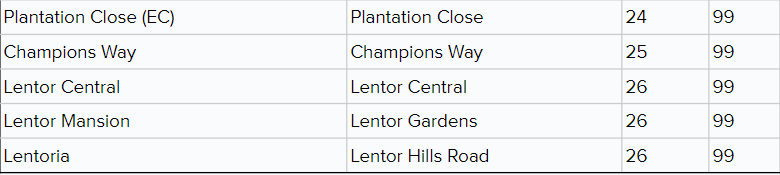

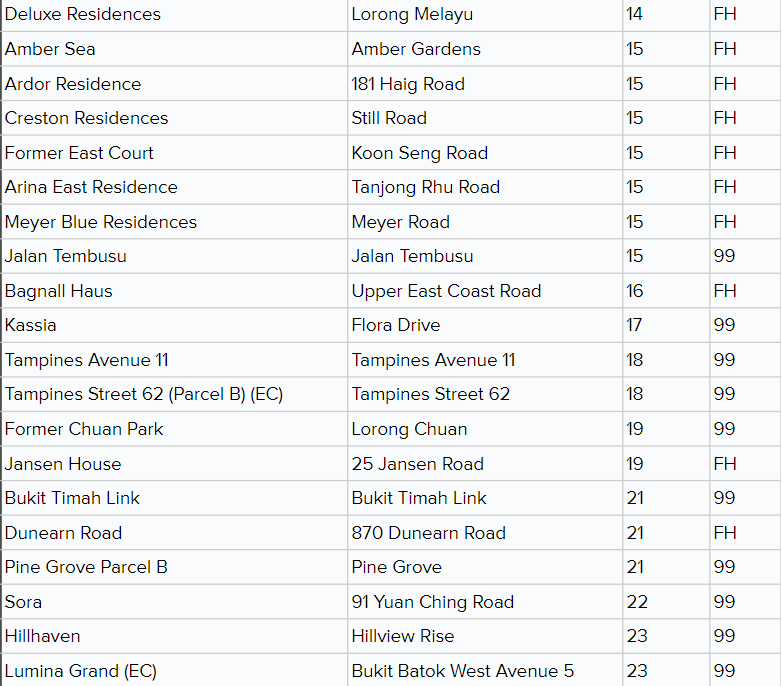

44 New Launches in 2024! Where Are the Opportunities?

44 new launches just seemed like a crazy amount when we compare to 2023 which only has 19 new launches! District 15 seemed to be the most popular among developers with the 7 new launches! (Tanjong Rhu, Meyer, Marine Parade, Katong, Amber Road, Joo Chiat, East Coast)

Some of the new launches in this list are more eye-catching and in this article, I will be picking out three new launches which are on the top of my list and providing reasons why I think so.

1. Clementi Avenue 1

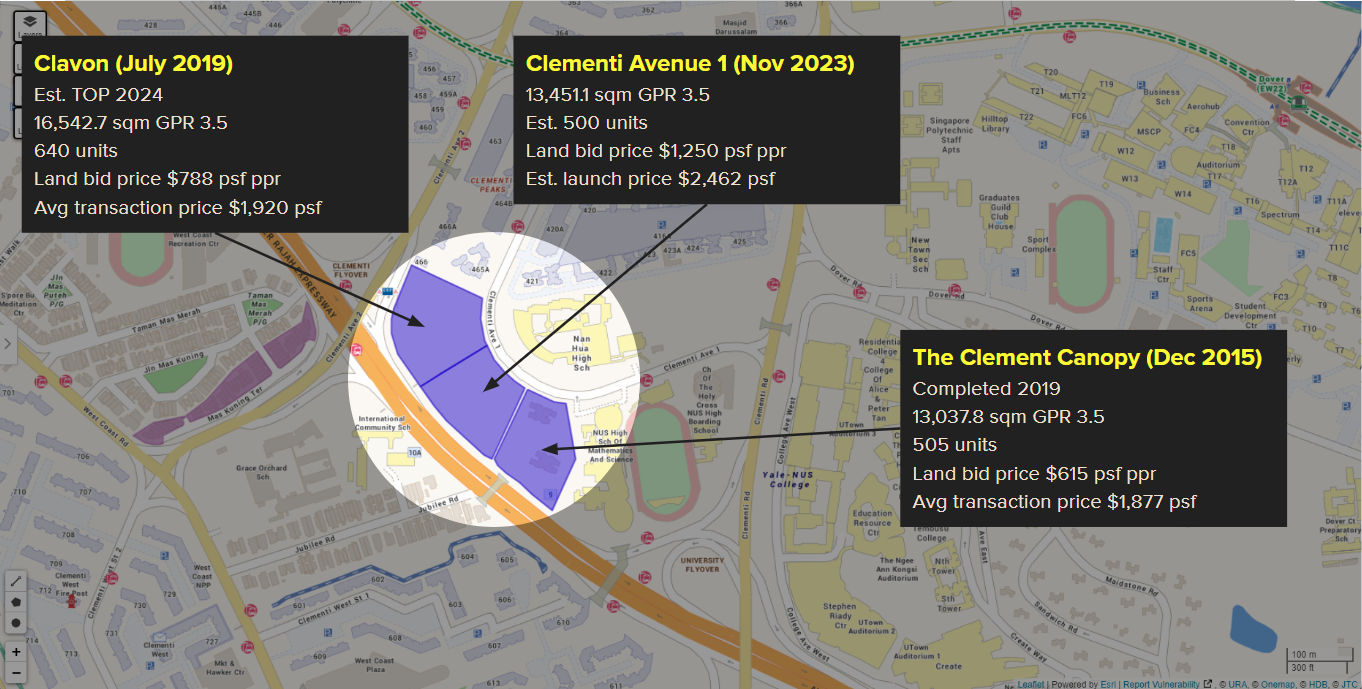

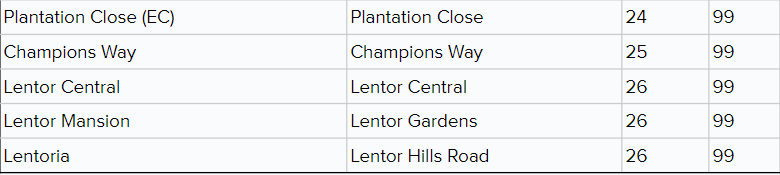

This new launch is sandwiched between Clavon and The Clement Canopy.

Source: URA, Squarefoot

There are several factors which make me feel like this project will stand out.

Firstly, it is adjacent to two good secondary schools, Nan Hua High School and NUS High School of Mathematics and Science. This is one of the key factors that would attract families with kids.

Furthermore, it is also easy access to Singapore Polytechnic, open to many tenant options like students, lecturers, and many more if you’re buying for investment.

Secondly, with over 400 units, the project would have more transactions once it is in the resale market, making its price more competitive. The maintenance fee for each unit will also be lower.

With the two adjacent projects having a similar number of units, they would be a good comparison to predict the performance of this new launch.

Both The Clement Canopy and Clavon performed well with an average annual growth of more than 5%.

Source: Squarefoot

Additionally, Clavon sold 70% of its units during its launch. Looking at the track record of these two projects, I feel like there is a good chance that the new launch is going to perform just as well.

However, the performance is subject to its launch price. With a ridiculously high launch price compared to the price psf of the other two projects, it would not perform as well as expected.

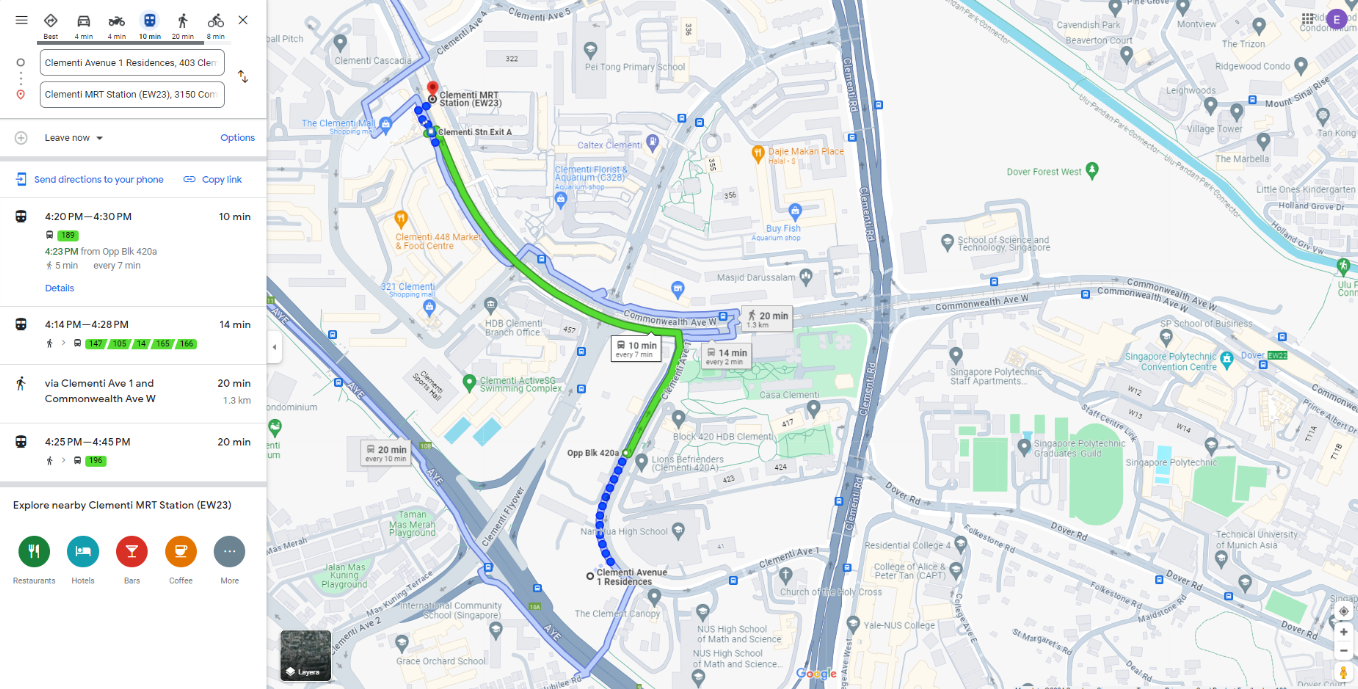

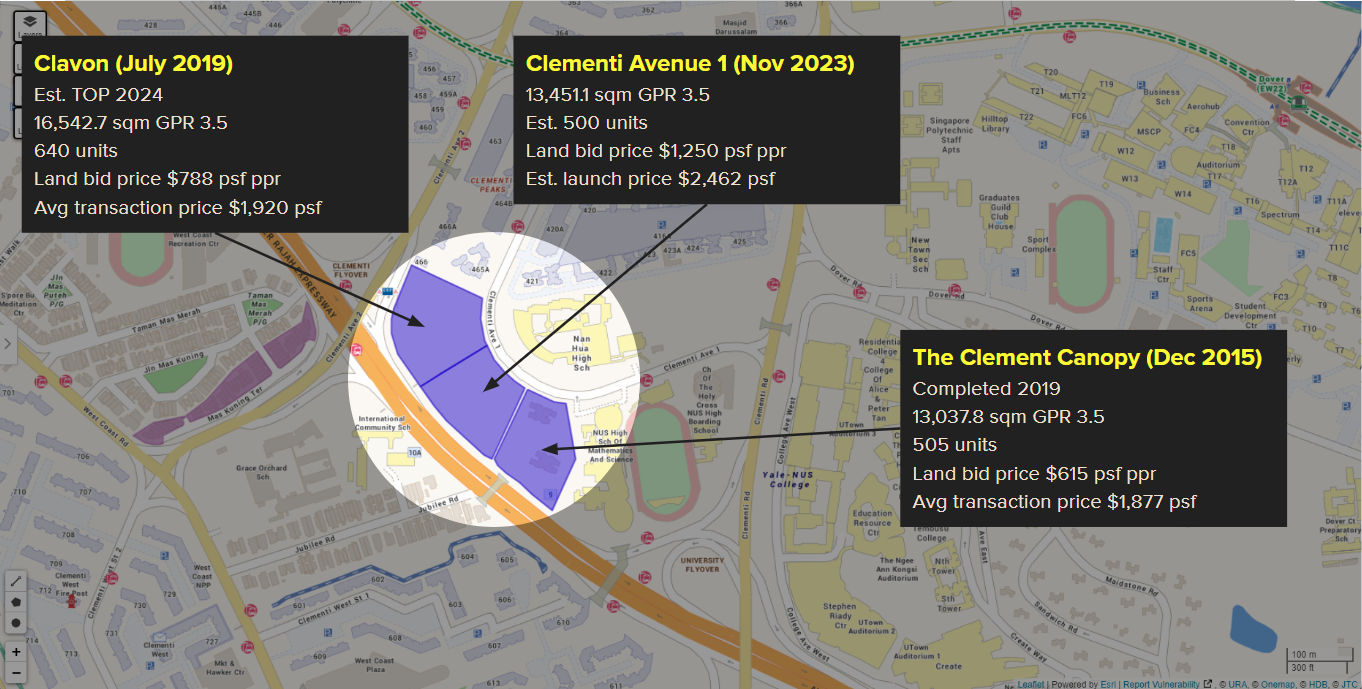

The small downside to these projects is the distance to the MRT. But there is a direct bus to the MRT and the amenities surrounding the station.

Source: Google Maps

2. Lorong 1 Toa Payoh

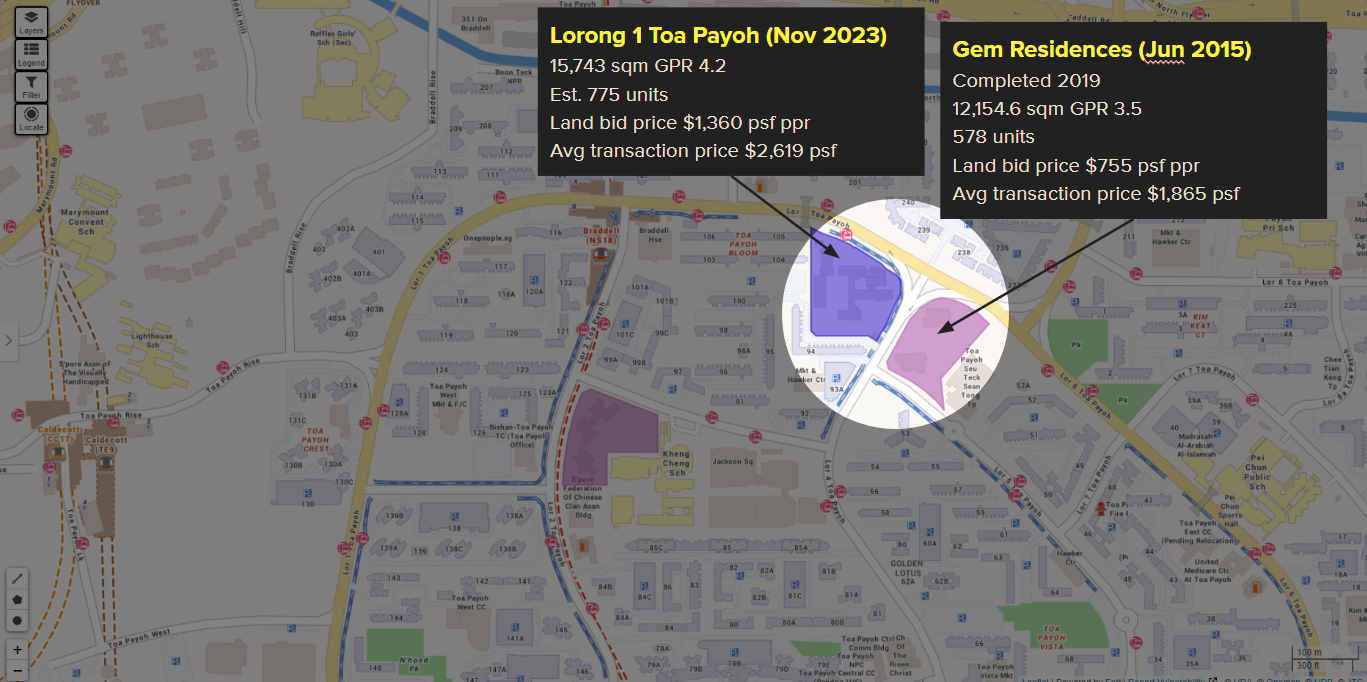

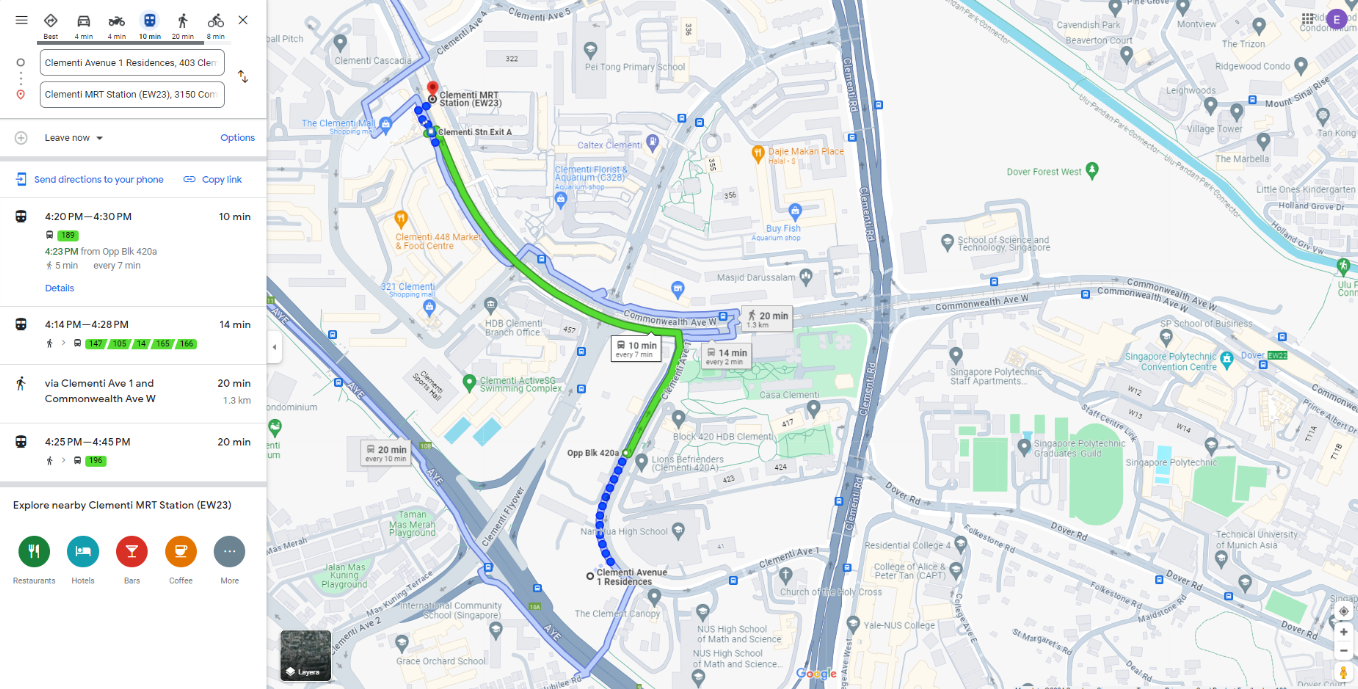

Source: URA, Squarefoot

This new launch is located right on top of the Police Security Command which is relocated to Lorong 8 Toa Payoh. With seven years without a new launch in Toa Payoh, this project could relieve some pent-up demand for private residential projects in the area.

With so many HDB flats surrounding the project, this provides a healthy demand from HDB upgraders, especially since Toa Payoh is one of the top three HDB towns with the most number of million-dollar flats.

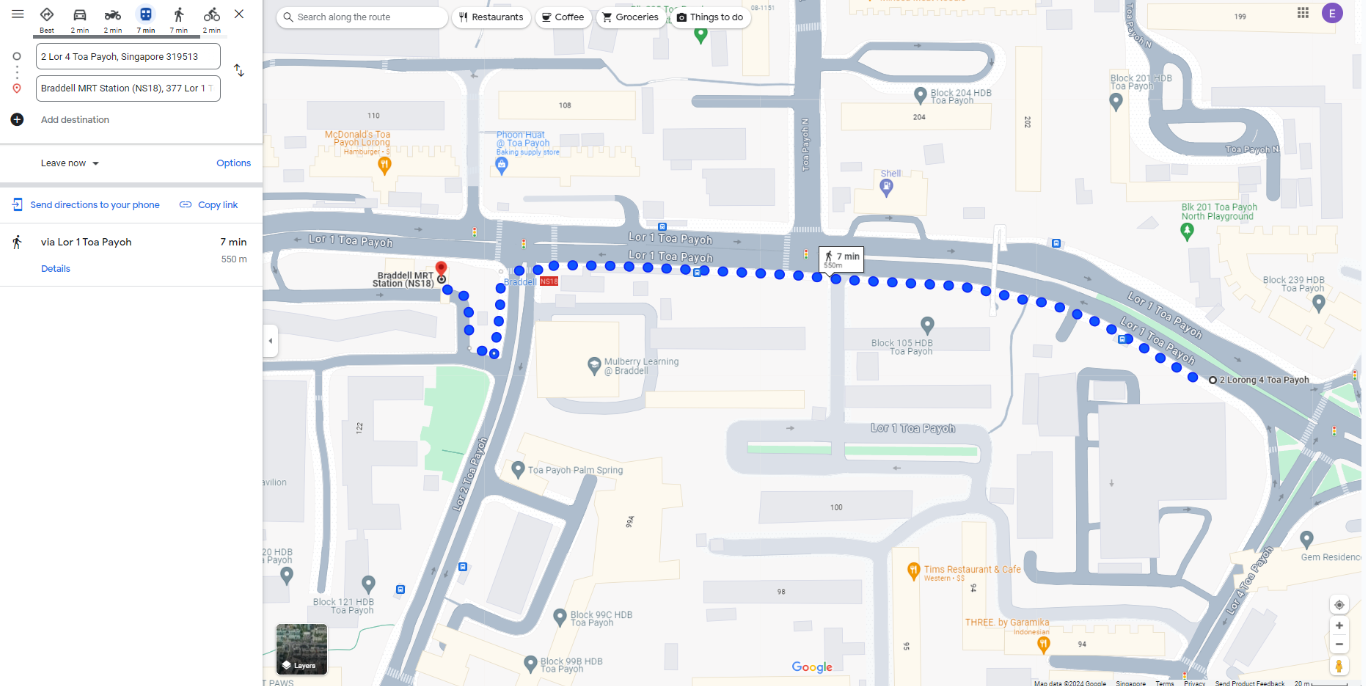

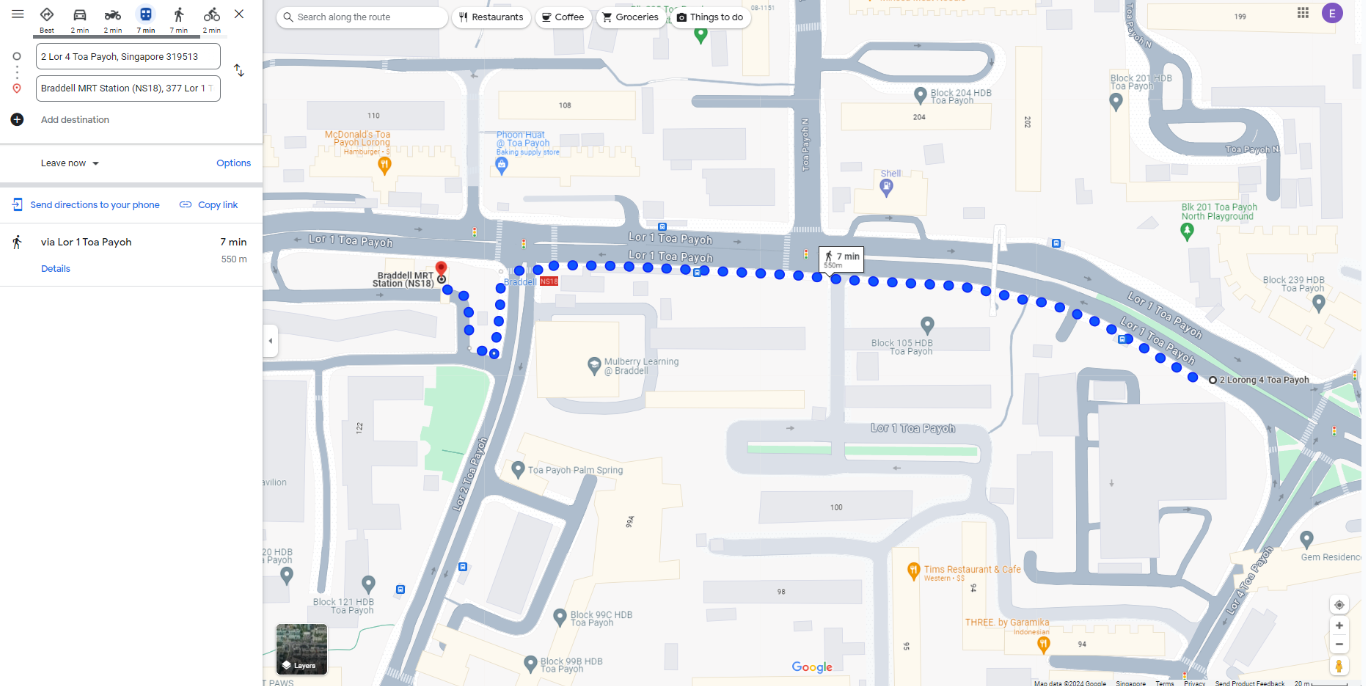

The close proximity to Braddell MRT makes this project even more attractive as it is only a 7-minute walk to the MRT.

Source: Google Maps

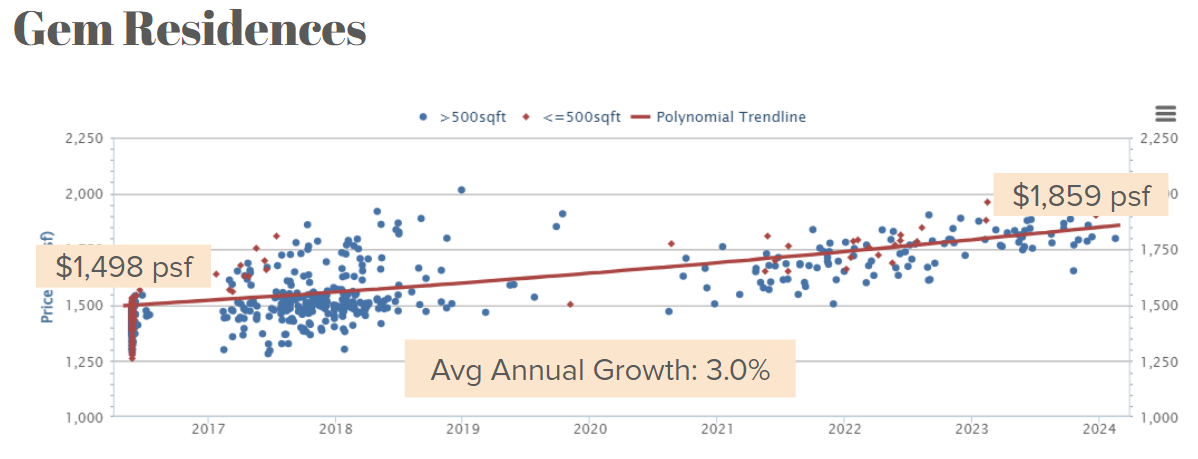

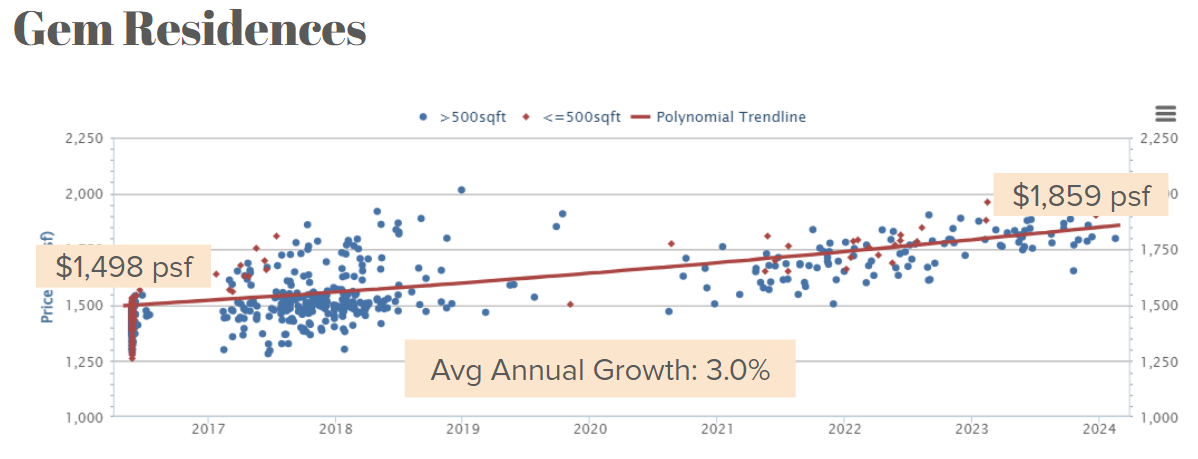

Looking at the performance of Gem Residences, it did not seem to perform as well as the market expected.

Source: Squarefoot

There are two main reasons, which in my opinion, contributed to the subpar performance of Gem Residences.

Firstly, it is further away from the MRT, much further compared to the new launch project. There are also not many amenities surrounding it.

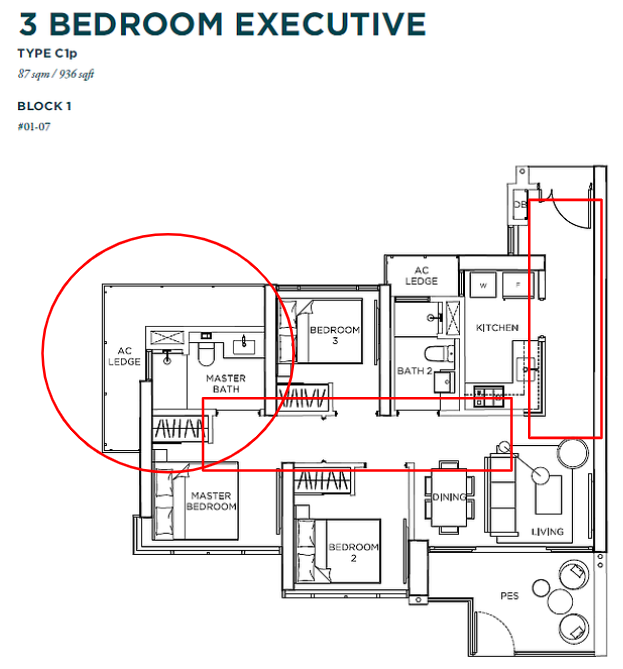

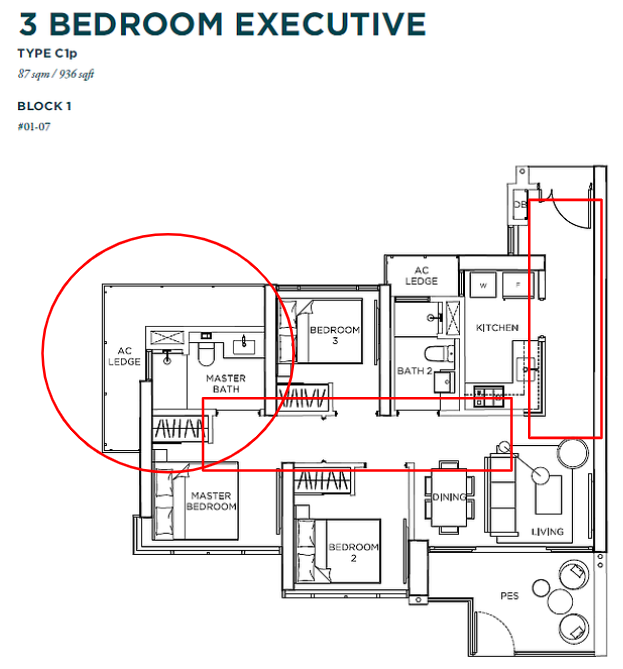

Secondly, the layout of Gem Residences units is not very attractive. Take an example of a 3-bedroom unit.

Source: Gem Residences

There are two very long walkways as well as a huge aircon ledge. Buyers are essentially paying for these spaces but cannot fully utilise them. The resulting usable space is also compromised, giving a less spacious feel.

Despite these shortcomings, Gem Residences still see an average increase of 3% in prices every year.

Depending on the layout and price of the new launch in Toa Payoh Lorong 1, it is likely to outperform Gem Residences considering it is situated in a better location and it provides an alternative for people seeking a private development in Toa Payoh after a long wait.

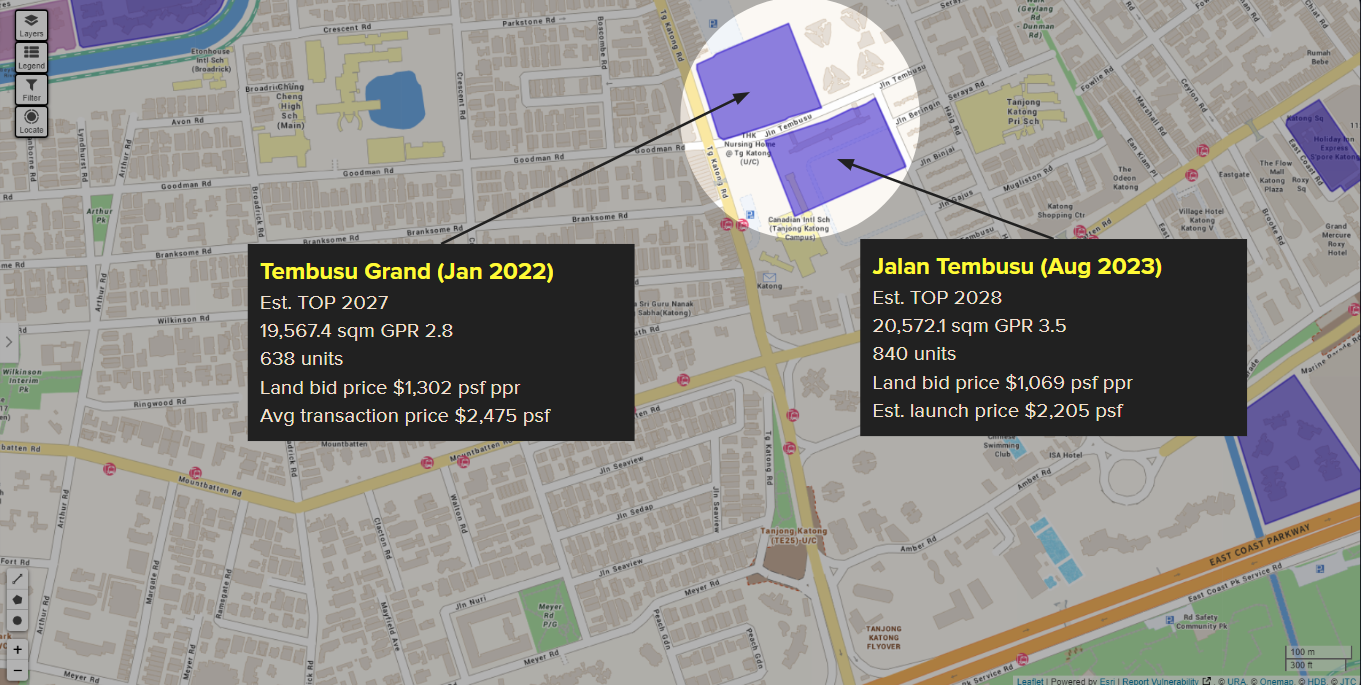

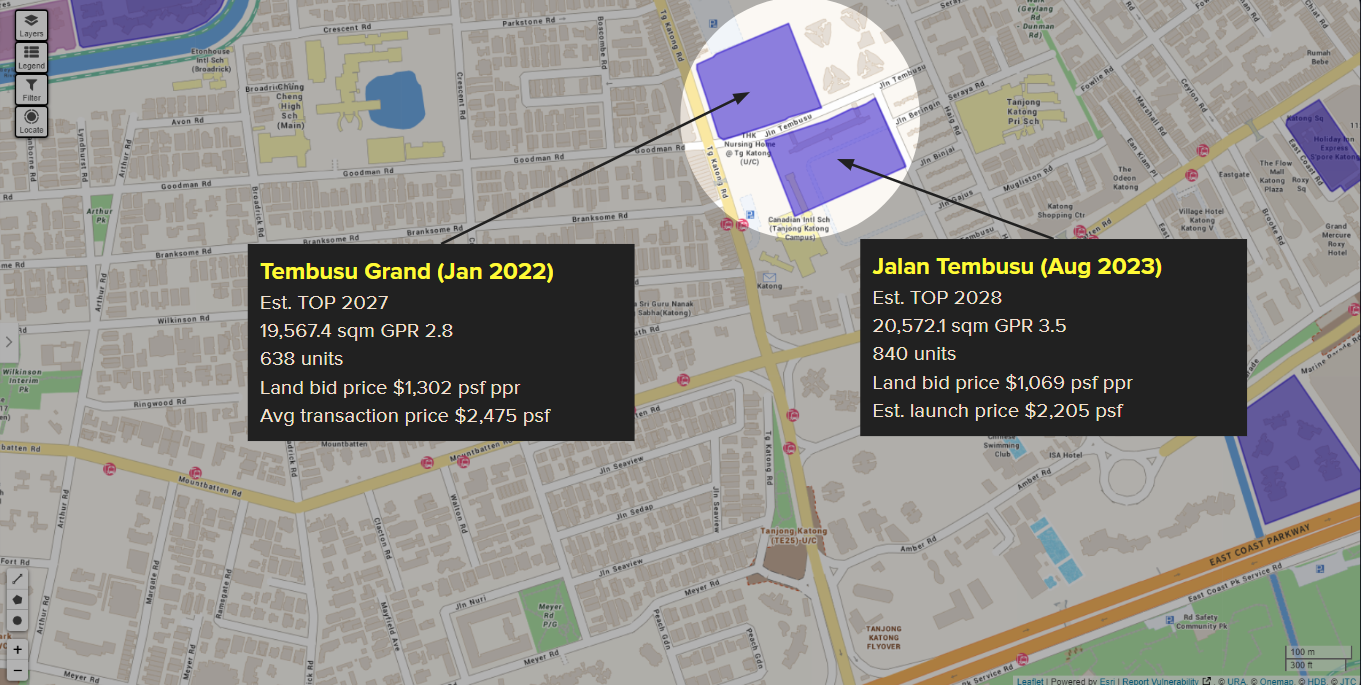

3. Jalan Tembusu

Source: URA, Squarefoot

Jalan Tembusu is located near the Tanjong Katong area and is surrounded by good schools such as Chung Cheng High School (Main) and Tanjong Katong Primary and Secondary School.

With the new Tanjong Katong MRT starting in June of this year, we can expect convenience for the residents staying in that area.

Furthermore, Tembusu Grand sold 53% of its units during its launch date (currently 61%).

What makes Jalan Tembusu an interesting plot is that it is adjacent to a very recent new launch, Tembusu Grand. However, Jalan Tembusu was acquired after the harmonisation of GFA definitions, while Tembusu Grand's land was purchased prior to this.

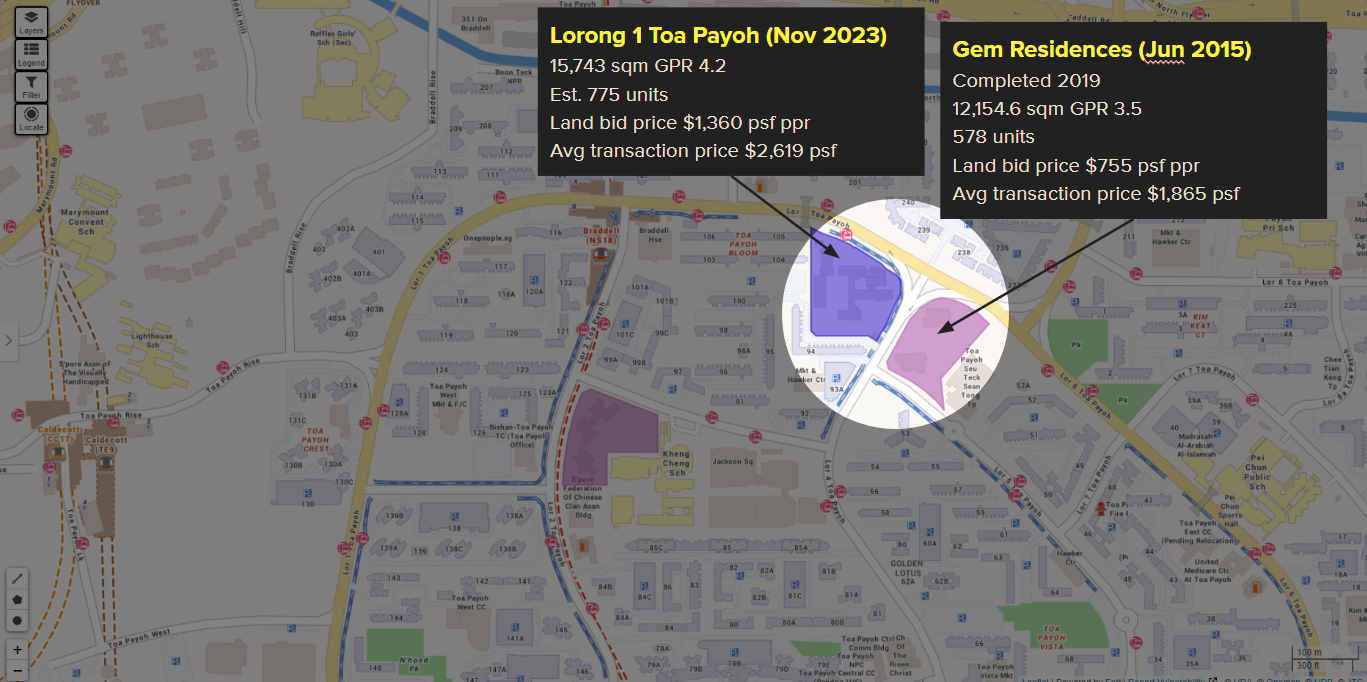

We see a similar situation happen in the Lentor area between Lentoria and Lentor Mansion, both launching within weeks of each other. Due to the GFA definition changes, the units for Lentoria and Lentor Mansion are built rather differently.

The performance of Lentoria and Lentor Mansion during their launch weekend was also drastically different, with Lentoria only selling 19% of its units while Lentor Mansion achieved 75%.

Thus, it will be interesting to observe how the developers will design the units in Jalan Tembusu as well as its performance during launch.

Must Read

Stay informed and inspired with the latest on real estate

44 New Launches in 2024! Where Are the Opportunities?

44 new launches just seemed like a crazy amount when we compare to 2023 which only has 19 new launches! District 15 seemed to be the most popular among developers with the 7 new launches! (Tanjong Rhu, Meyer, Marine Parade, Katong, Amber Road, Joo Chiat, East Coast)

Some of the new launches in this list are more eye-catching and in this article, I will be picking out three new launches which are on the top of my list and providing reasons why I think so.

1. Clementi Avenue 1

This new launch is sandwiched between Clavon and The Clement Canopy.

Source: URA, Squarefoot

There are several factors which make me feel like this project will stand out.

Firstly, it is adjacent to two good secondary schools, Nan Hua High School and NUS High School of Mathematics and Science. This is one of the key factors that would attract families with kids.

Furthermore, it is also easy access to Singapore Polytechnic, open to many tenant options like students, lecturers, and many more if you’re buying for investment.

Secondly, with over 400 units, the project would have more transactions once it is in the resale market, making its price more competitive. The maintenance fee for each unit will also be lower.

With the two adjacent projects having a similar number of units, they would be a good comparison to predict the performance of this new launch.

Both The Clement Canopy and Clavon performed well with an average annual growth of more than 5%.

Source: Squarefoot

Additionally, Clavon sold 70% of its units during its launch. Looking at the track record of these two projects, I feel like there is a good chance that the new launch is going to perform just as well.

However, the performance is subject to its launch price. With a ridiculously high launch price compared to the price psf of the other two projects, it would not perform as well as expected.

The small downside to these projects is the distance to the MRT. But there is a direct bus to the MRT and the amenities surrounding the station.

Source: Google Maps

2. Lorong 1 Toa Payoh

Source: URA, Squarefoot

This new launch is located right on top of the Police Security Command which is relocated to Lorong 8 Toa Payoh. With seven years without a new launch in Toa Payoh, this project could relieve some pent-up demand for private residential projects in the area.

With so many HDB flats surrounding the project, this provides a healthy demand from HDB upgraders, especially since Toa Payoh is one of the top three HDB towns with the most number of million-dollar flats.

The close proximity to Braddell MRT makes this project even more attractive as it is only a 7-minute walk to the MRT.

Source: Google Maps

Looking at the performance of Gem Residences, it did not seem to perform as well as the market expected.

Source: Squarefoot

There are two main reasons, which in my opinion, contributed to the subpar performance of Gem Residences.

Firstly, it is further away from the MRT, much further compared to the new launch project. There are also not many amenities surrounding it.

Secondly, the layout of Gem Residences units is not very attractive. Take an example of a 3-bedroom unit.

Source: Gem Residences

There are two very long walkways as well as a huge aircon ledge. Buyers are essentially paying for these spaces but cannot fully utilise them. The resulting usable space is also compromised, giving a less spacious feel.

Despite these shortcomings, Gem Residences still see an average increase of 3% in prices every year.

Depending on the layout and price of the new launch in Toa Payoh Lorong 1, it is likely to outperform Gem Residences considering it is situated in a better location and it provides an alternative for people seeking a private development in Toa Payoh after a long wait.

3. Jalan Tembusu

Source: URA, Squarefoot

Jalan Tembusu is located near the Tanjong Katong area and is surrounded by good schools such as Chung Cheng High School (Main) and Tanjong Katong Primary and Secondary School.

With the new Tanjong Katong MRT starting in June of this year, we can expect convenience for the residents staying in that area.

Furthermore, Tembusu Grand sold 53% of its units during its launch date (currently 61%).

What makes Jalan Tembusu an interesting plot is that it is adjacent to a very recent new launch, Tembusu Grand. However, Jalan Tembusu was acquired after the harmonisation of GFA definitions, while Tembusu Grand's land was purchased prior to this.

We see a similar situation happen in the Lentor area between Lentoria and Lentor Mansion, both launching within weeks of each other. Due to the GFA definition changes, the units for Lentoria and Lentor Mansion are built rather differently.

The performance of Lentoria and Lentor Mansion during their launch weekend was also drastically different, with Lentoria only selling 19% of its units while Lentor Mansion achieved 75%.

Thus, it will be interesting to observe how the developers will design the units in Jalan Tembusu as well as its performance during launch.

Discover local real estate gems and insightful properties reviews

Check out our local Youtube Channel

Hello, How Can We Help?

Got any questions for us? Let us know what you need answers to and we'll be in touch with you

By submitting, you agree to receive future marketing materials from Crestbrick Pte Ltd. Your personal information will be used according to our privacy policy. You may also drop us an email at [email protected].