Discover The Latest In Real Estate

Stay in the loop with the latest in local and global real estate. Watch insightful property reviews, explore opportunities in foreign real estate, and check out must-read articles which keep you informed and on track with the ever-evolving world of real estate.

Discover The Latest In Real Estate

Stay in the loop with the latest in local and global real estate. Watch insightful property reviews, explore opportunities in foreign real estate, and check out must-read articles which keep you informed and on track with the ever-evolving world of real estate.

Crestbrick Global

Explore global real estate opportunities

Must Read

Stay informed and inspired with the latest on real estate

Assessing Your Financial Readiness to Buy a Property in Singapore

Buying a house is a very big step in everyone’s life, and it requires careful financial planning to ensure that you are able to purchase the property you want. Here is everything you need to know to determine if you're financially ready to buy your dream home.

Step 1: Calculating Your Budget

Calculating your budget can help to set up a better expectation of the kind of house that you will be able to purchase according to your finances. Here’s a look at how to determine your budget.

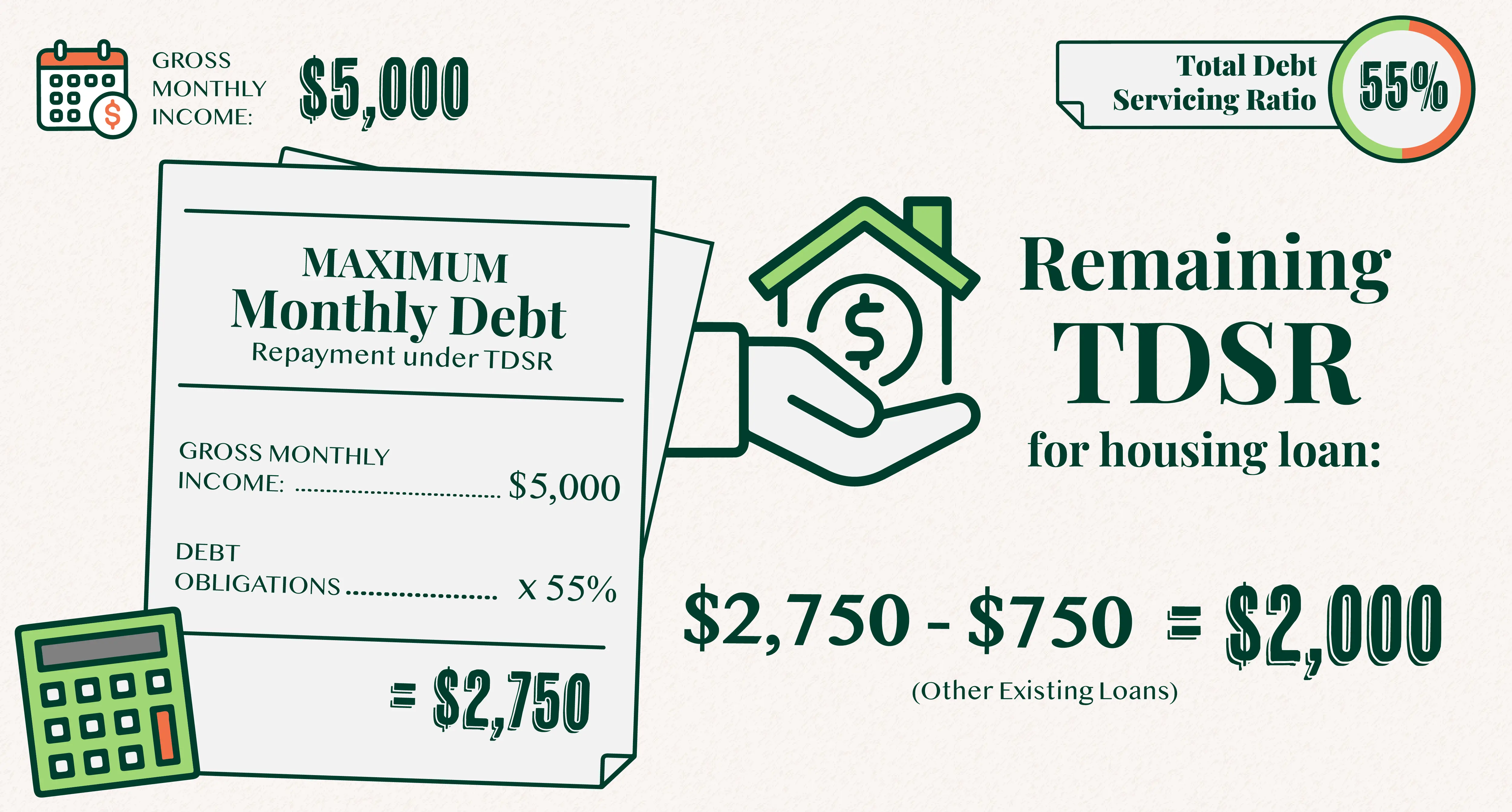

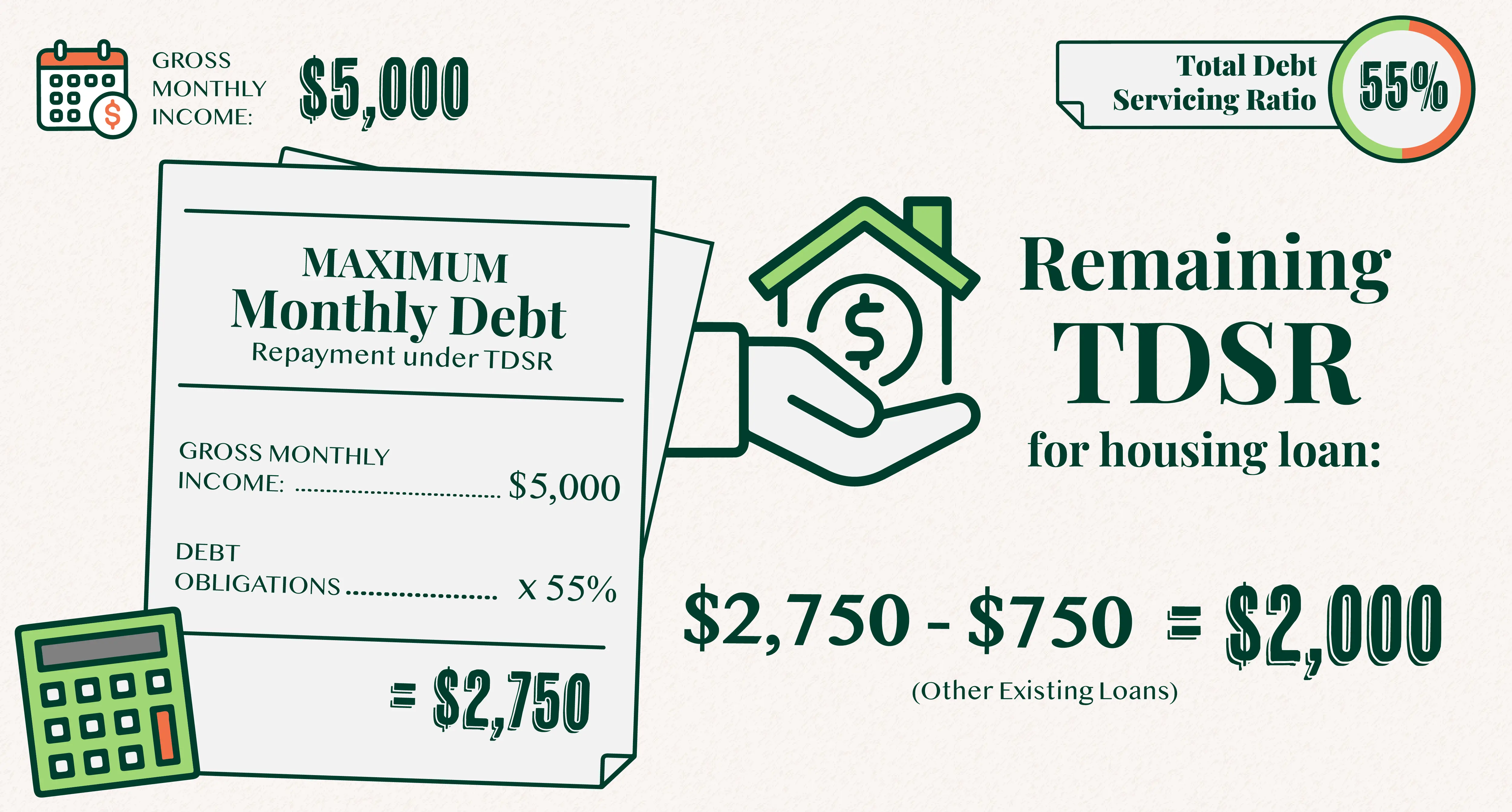

Understanding the Total Debt Servicing Ratio (TDSR)

The Monetary Authority of Singapore introduced the Total Debt Servicing Ratio (TDSR) to promote financial prudence. Under this regulation, your total monthly debt obligations cannot exceed 55% of your gross monthly income. This rule applies to all property purchases, whether for HDB apartments, executive condominiums, private properties, or even commercial and industrial properties.

Sources: CPF Board

Example:

Gross monthly income: $5,000

Maximum monthly debt repayment under TDSR: $5,000 × 55% = $2,750

Any existing loan that you might have, such as a car loan with a monthly repayment of $750, will reduce your housing loan eligibility:

Remaining TDSR for housing loan: $2,750 - $750 = $2,000

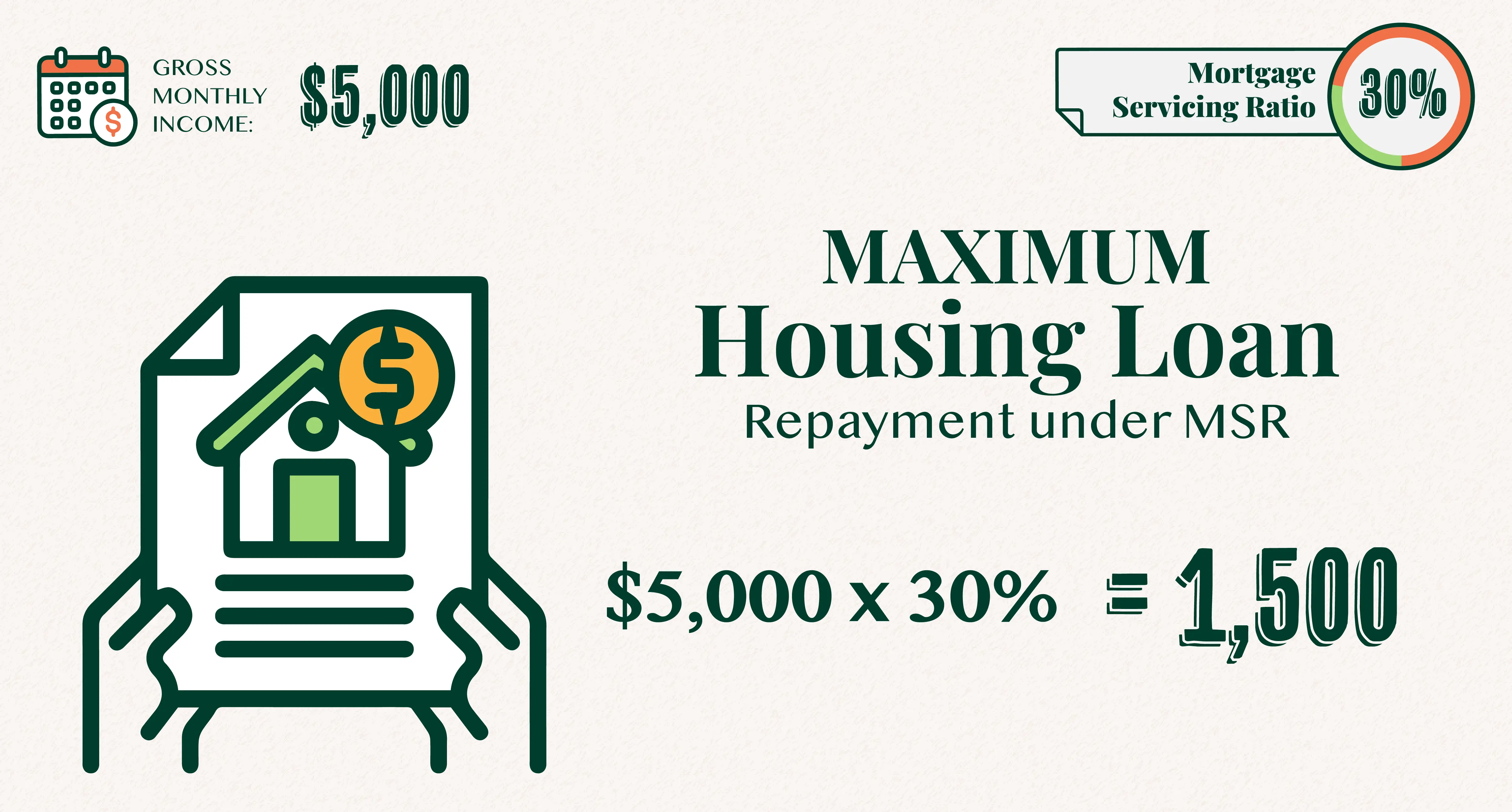

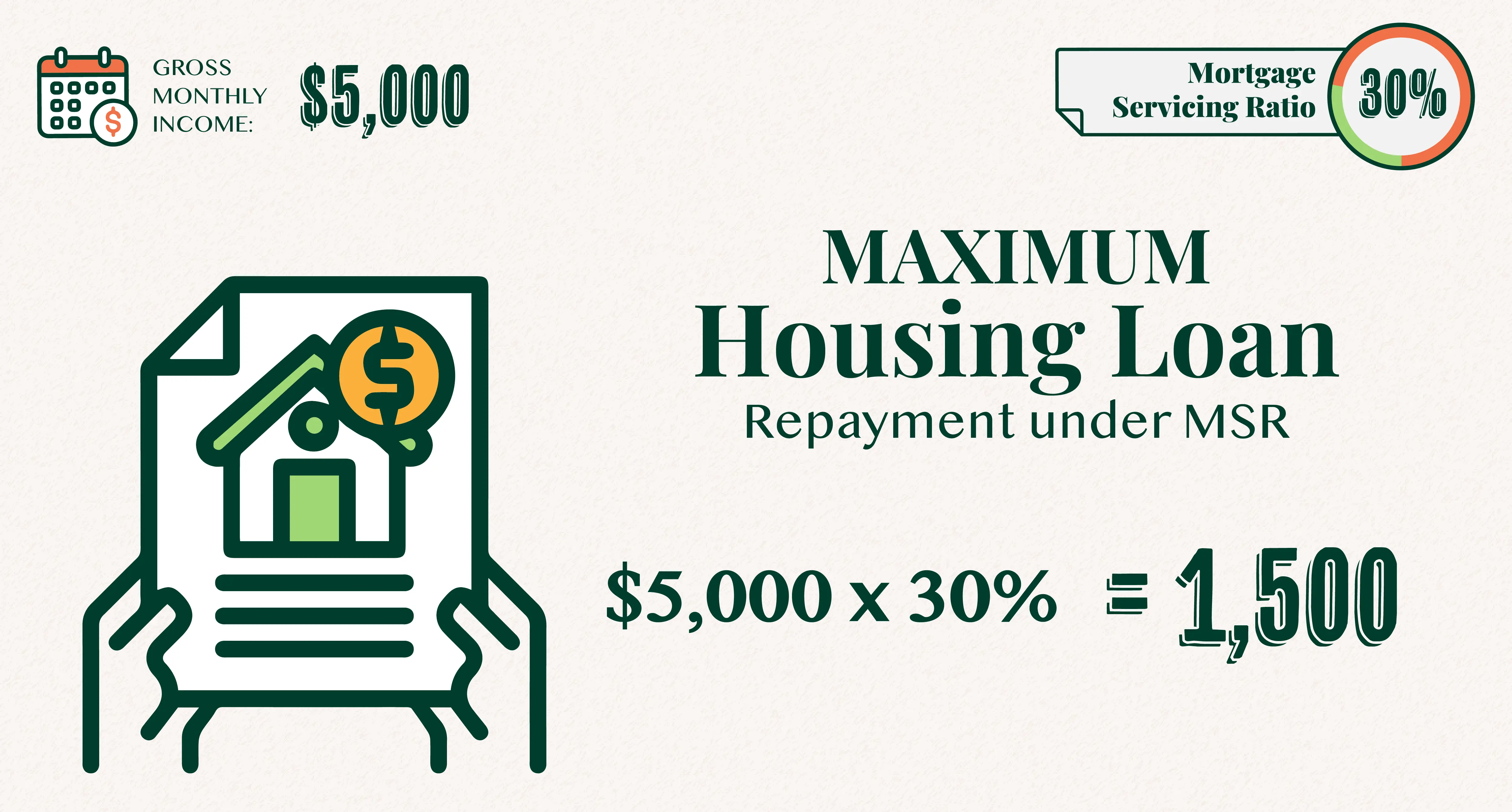

Understanding the Mortgage Servicing Ratio (MSR)

Mortgage servicing ratio (MSR) refers to the portion of a borrower’s gross monthly income that goes towards repaying "all property loans". If you’re purchasing an HDB apartment or executive condominium, you can adhere to the Mortgage Servicing Ratio (MSR) instead of TDSR. Under MSR, a cap of 30% of your gross monthly income can be used for your monthly housing loan repayments.

Sources: DollarsAndSense

Considering Additional Costs

Your budget doesn’t just end with the property’s purchasing price. It’s also important to account for any other additional costs, which can significantly impact your affordability:

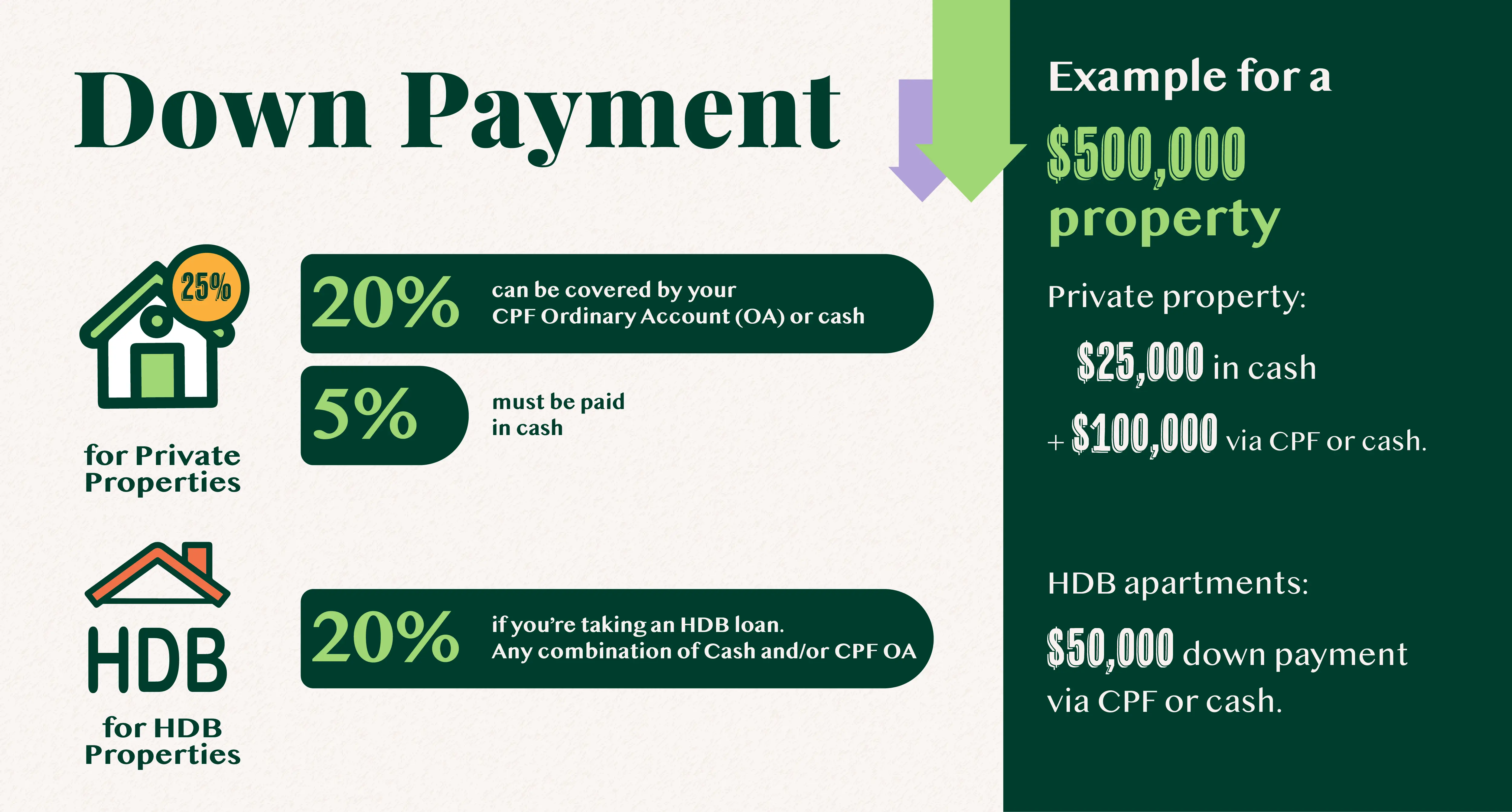

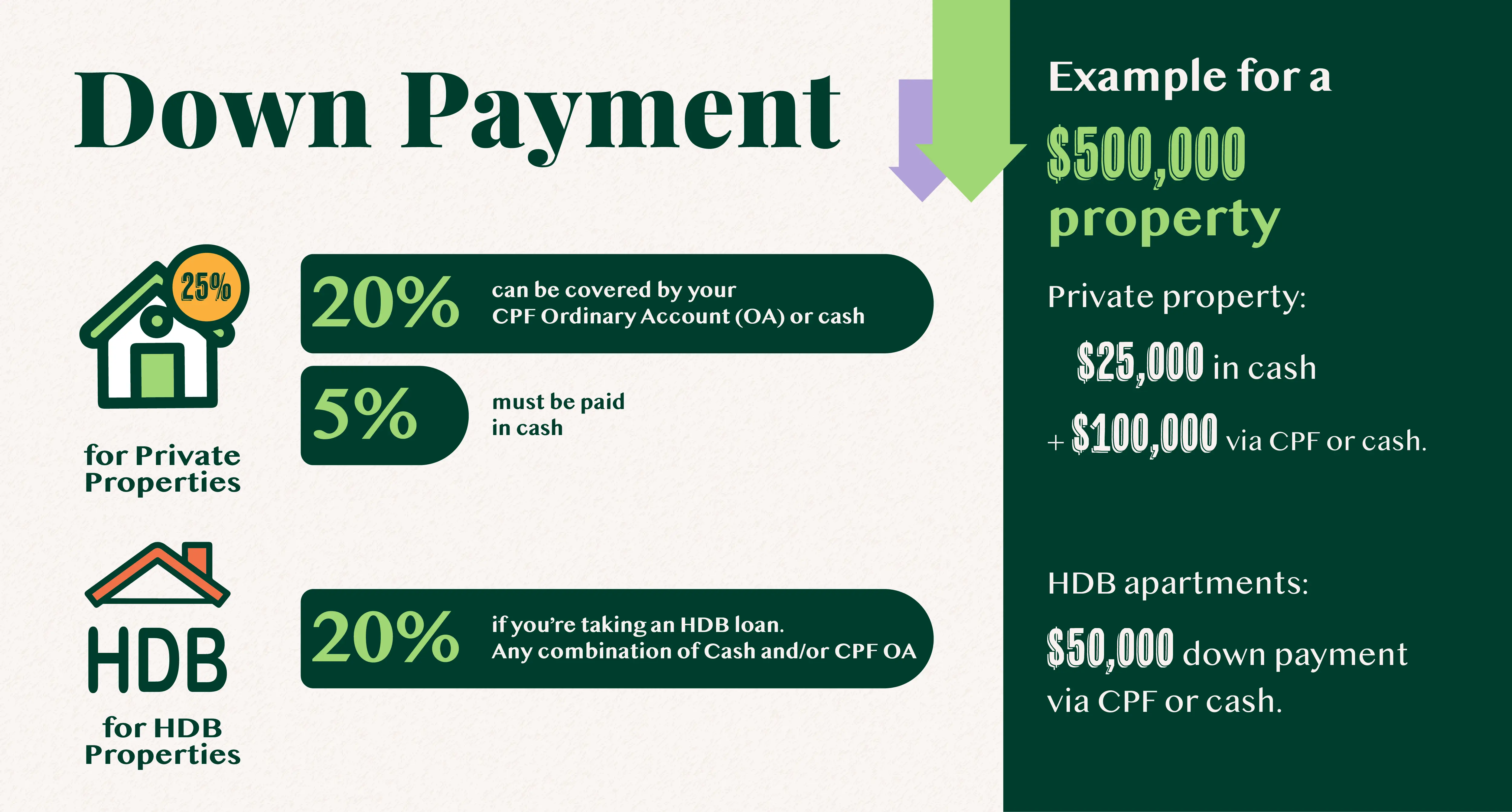

Downpayment: The amount that a property buyer pays up front when purchasing a property. It is usually a percentage of the purchase price of the property.

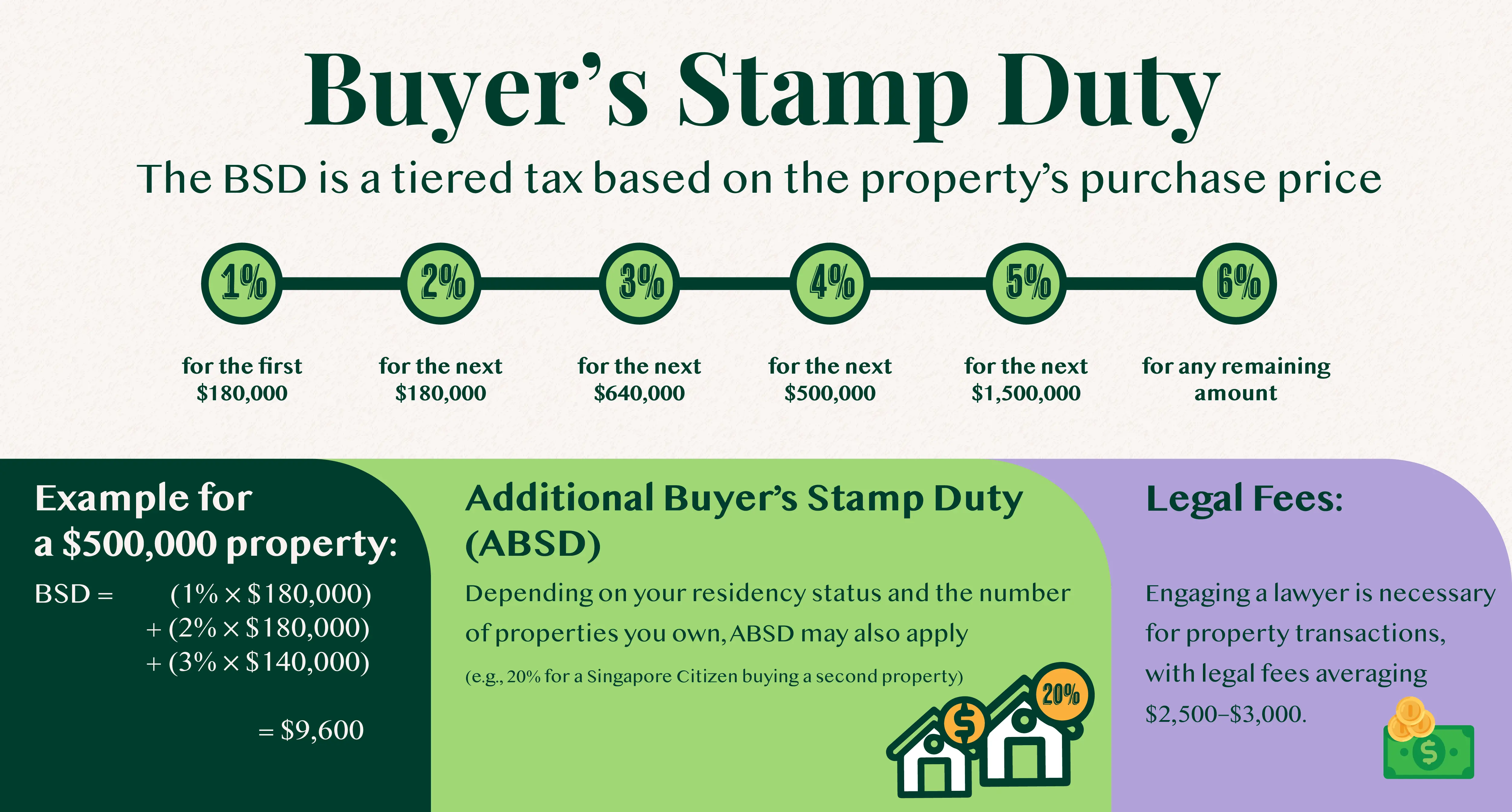

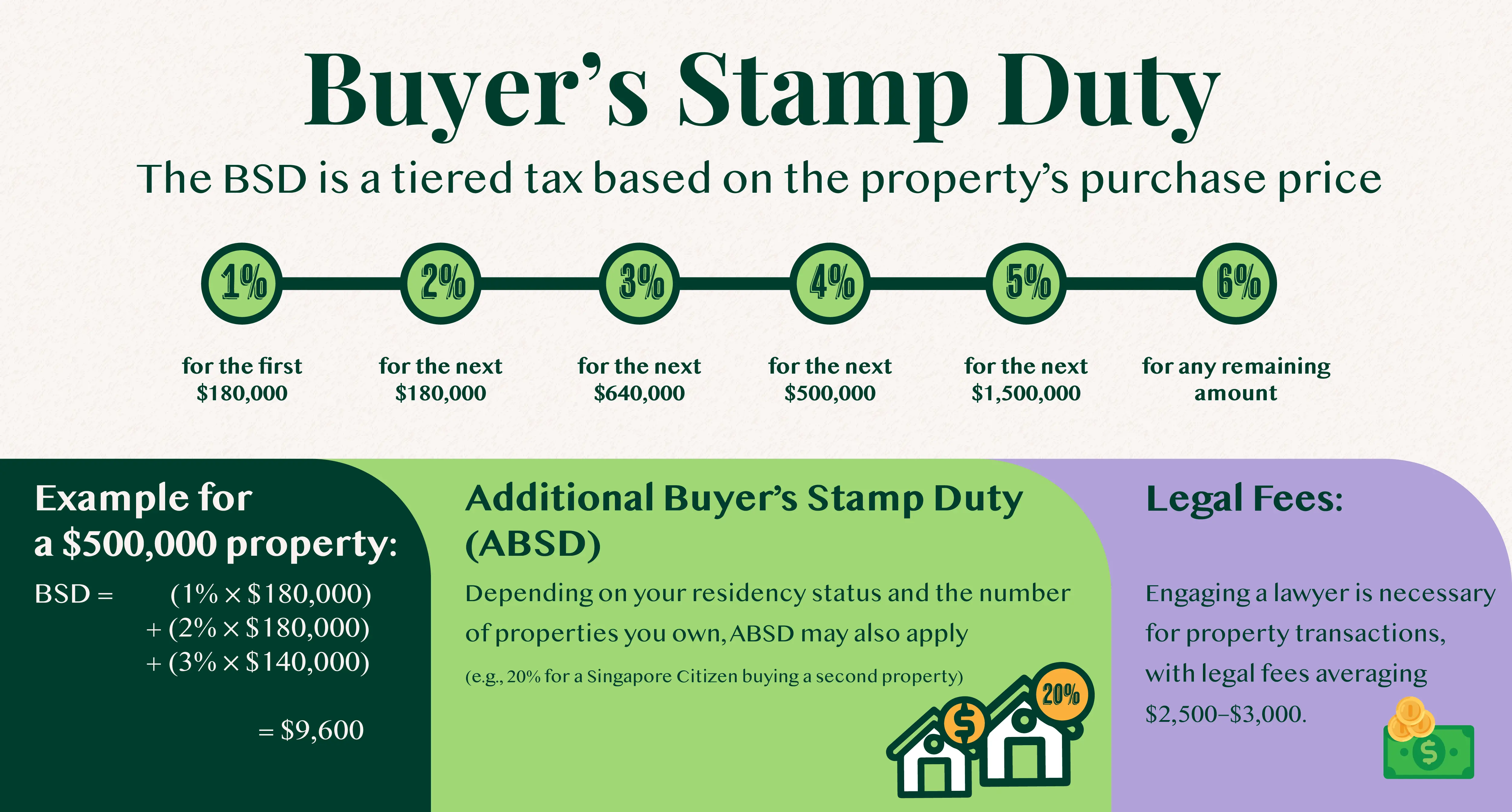

Buyer’s Stamp Duty (BSD): The BSD is a tiered tax based on the property’s purchase price.

Sources: Inland Revenue Authority of Singapore Buyer Stamp Duty, Inland Revenue Authority of Singapore Additional Buyer Stamp Duty and DBS

Set Realistic Expectations

Once you’ve calculated your TDSR and MSR limits and factored in additional costs, you’ll have a clearer picture of the property you can afford. For instance:

If your TDSR allows for a maximum loan of $800,000 and you have $200,000 in CPF and cash savings for the down payment, your expected budget is $1,000,000.

Consider leaving room for other expenses, such as renovations, home styling or repairs, by purchasing a property slightly below your expected budget.

How to Use Online Tools to Simplify Budgeting

Various online calculators, such as the Loan Expert Calculator and IQuadrant Mortgage Calculator, can help you determine your loan eligibility and monthly repayments. These tools can provide quick and accurate estimates, saving you time and effort.

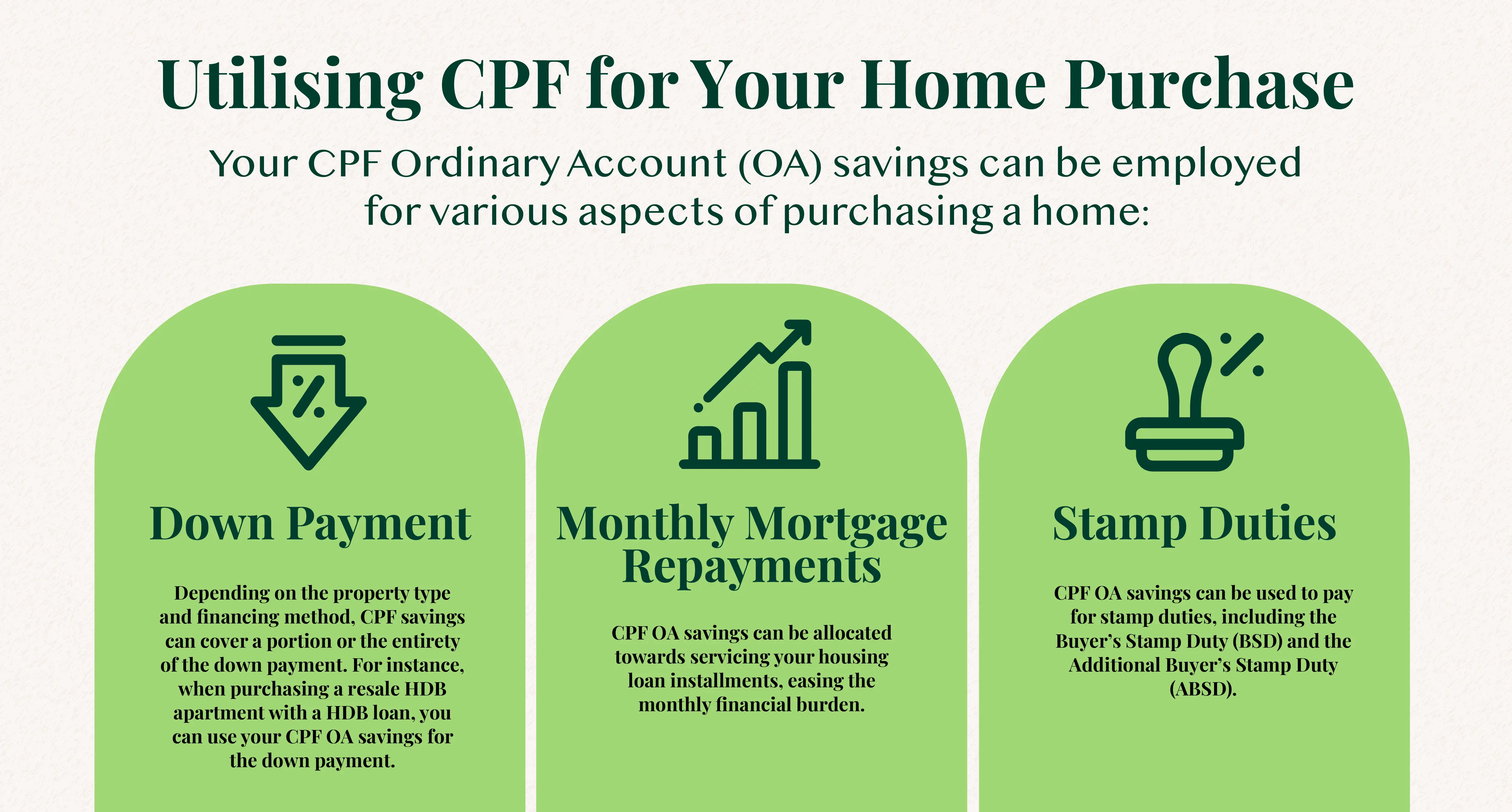

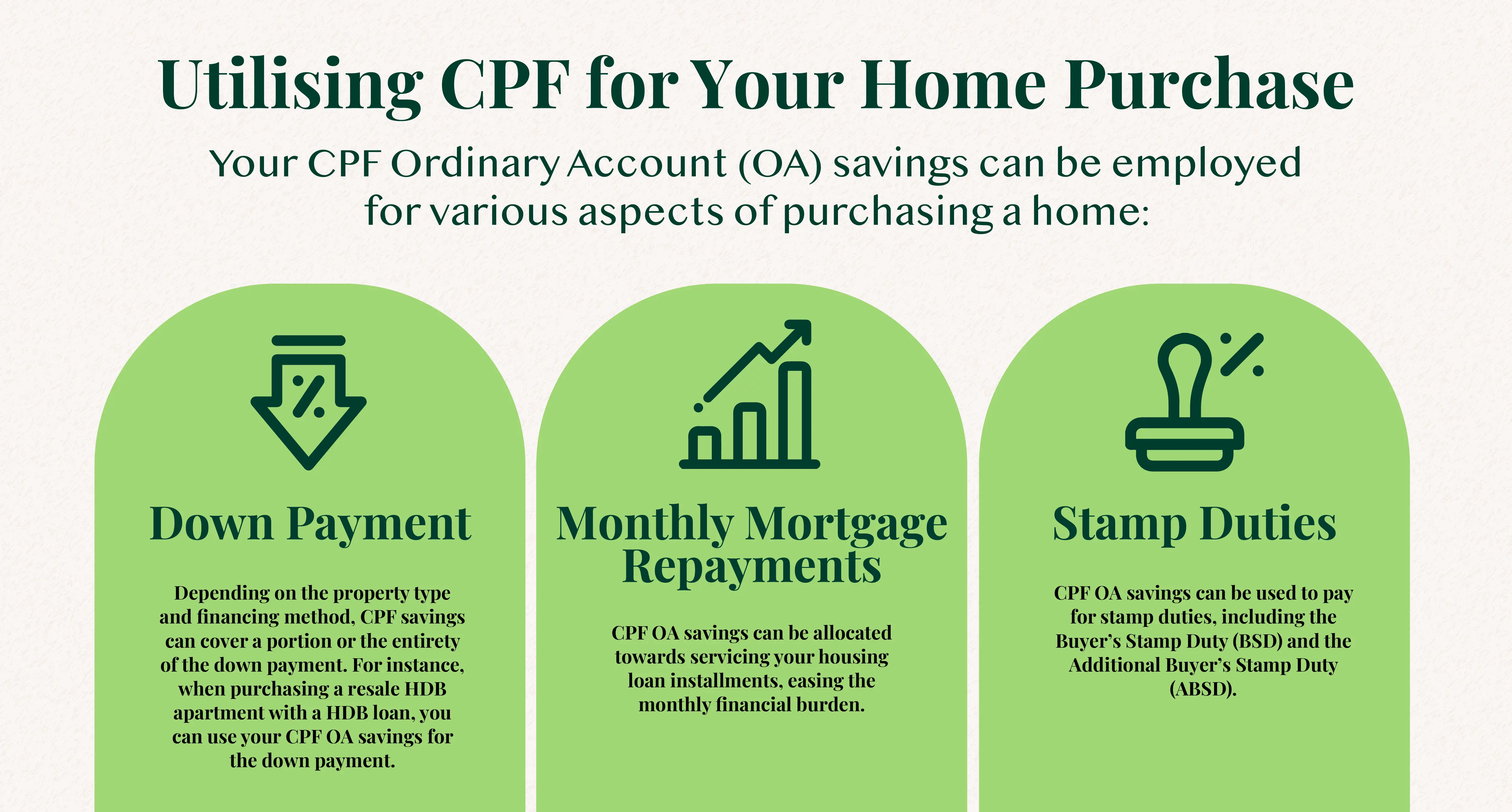

Step 2: Leveraging CPF and Cash Savings

The Central Provident Fund (CPF) can offer substantial support in financing a property purchase. However, it is important to understand both its capabilities and limitations to ensure a smooth property buying journey.

Down Payment: CPF OA savings can fully or partially cover down payments, such as for resale HDB apartments with an HDB loan.

Monthly Mortgage Repayments: Use CPF OA funds for housing loan installments, reducing monthly expenses.

Stamp Duties: CPF savings can pay stamp duties, including BSD and ABSD (if applicable).

Sources: Housing and Development Board and CPF Board

Limitations of CPF Usage

While CPF provides significant assistance, it doesn't cover all expenses. Bank loans still require a portion of the down payment to be made in cash. When financing through a bank, at least 5% of the property purchase price must be paid in cash, with an additional 20% that can be covered using any combination of CPF OA savings or cash.

Sources: SingSaver

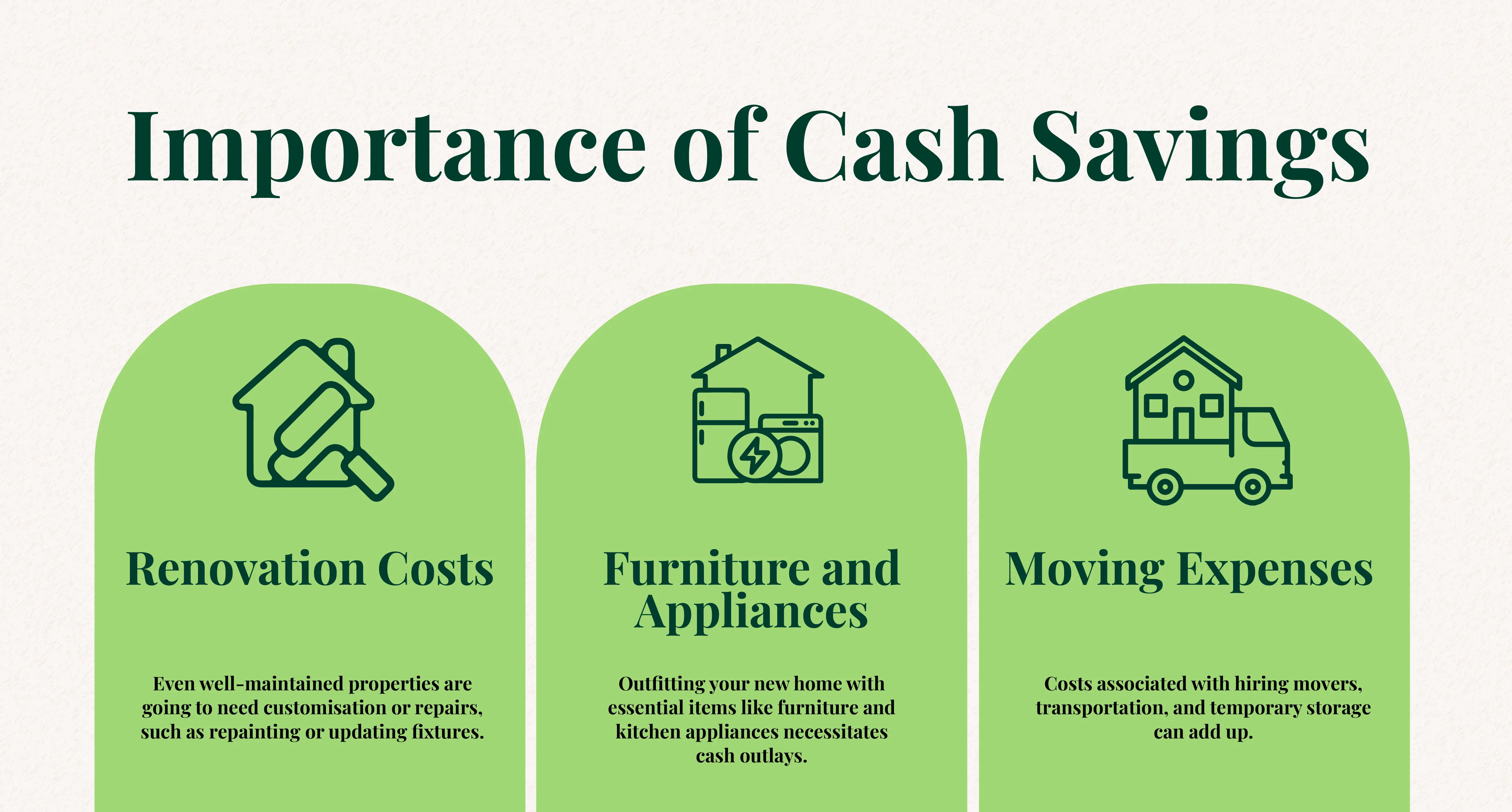

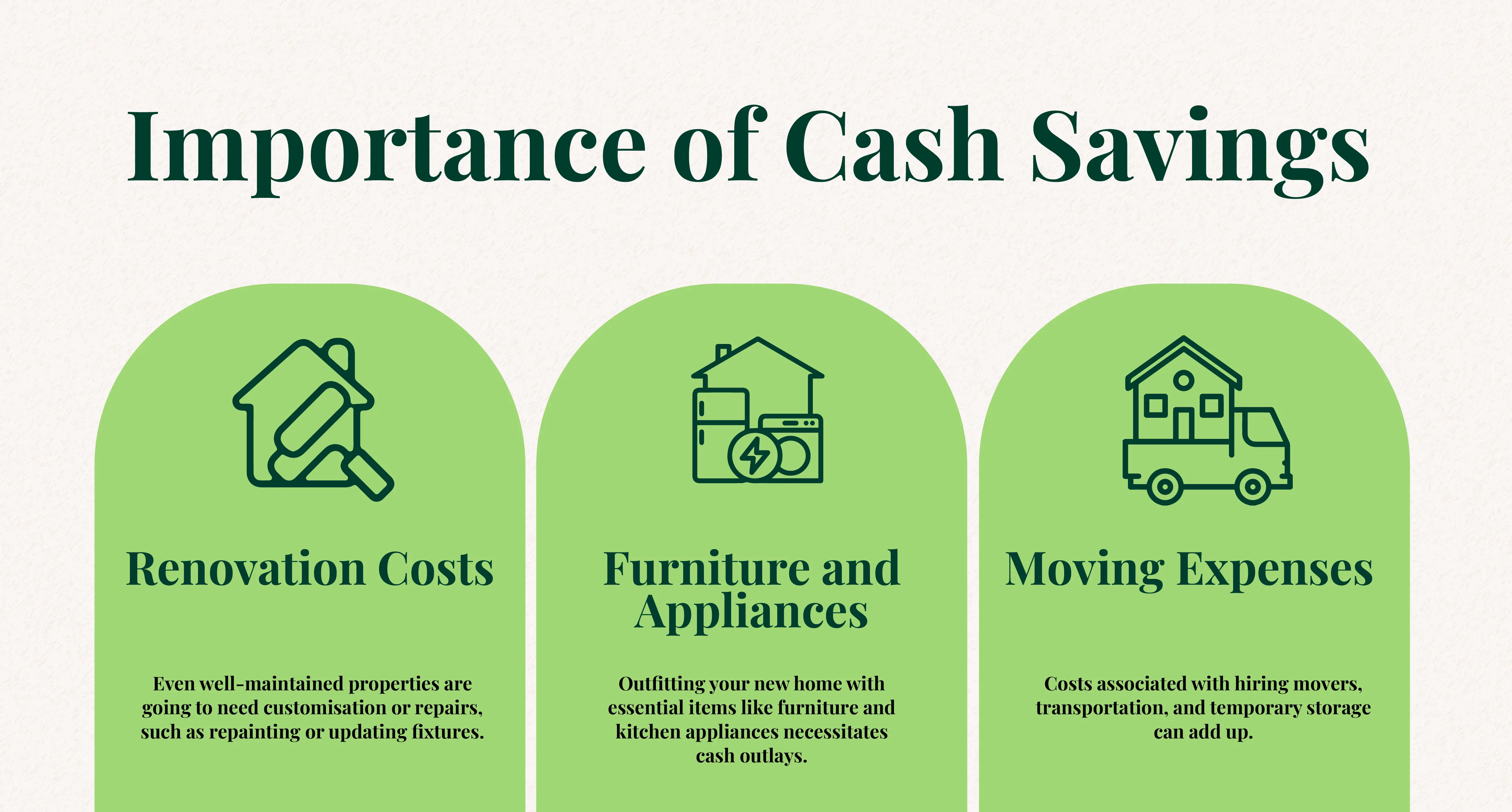

Importance of Cash Savings

Beyond the initial purchase, several expenses also require cash payments:

CPF Withdrawal Limits and Housing Valuation

Be aware that CPF usage is also subjected to withdrawal limits tied to the property's Valuation Limit (VL) and Withdrawal Limit (WL):

Valuation Limit (VL): The lower of the purchase price or the market valuation of the property at the time of purchase.

Withdrawal Limit (WL): Capped at 120% of the Valuation Limit. Exceeding this amount may require setting aside funds in your CPF Retirement Account (RA).

Impact of Property Lease on CPF Usage

The remaining lease of the property plays a significant role in determining the extent of CPF usage:

Lease Covers Youngest Buyer Until Age 95: If the property's remaining lease can cover the youngest buyer until at least the age of 95, you can use your CPF savings up to the property VL.

Lease Does Not Cover Youngest Buyer Until Age 95: If the remaining lease is insufficient to cover the youngest buyer until age 95, the maximum amount of CPF savings that can be used is prorated. This amount is based on how much the remaining lease covers the youngest buyer up to age 95. This measure ensures that buyers retain adequate CPF savings for future housing needs when their lease ends.

Sources: CPF

Key Considerations

Minimum Lease Requirement: CPF savings cannot be used if the property's remaining lease is less than 20 years.

Sources: Ministry of National Development

Setting Aside Retirement Sum: To utilize CPF savings beyond the VL, up to the WL, you must set aside the prevailing funds in your RA.

Sources: Dollars and Sense

Regular Updates: CPF policies are subject to periodic updates. It's advisable to consult the CPF Board's official website or contact them directly for the most current information.

Balancing CPF and Cash

While CPF does ease the financial burden of buying a home, do be mindful that it is not a substitute for cash liquidity. Over-reliance on CPF can leave you vulnerable to expenses it doesn't cover. Striking the right balance between CPF usage and cash reserves ensures you're financially prepared for both expected and unexpected costs.

Step 3: Securing Financing

Securing financing is the next step in the home buying process in Singapore. Understanding the available loan options and their requirements ensures a smoother transaction and helps you make informed decisions.

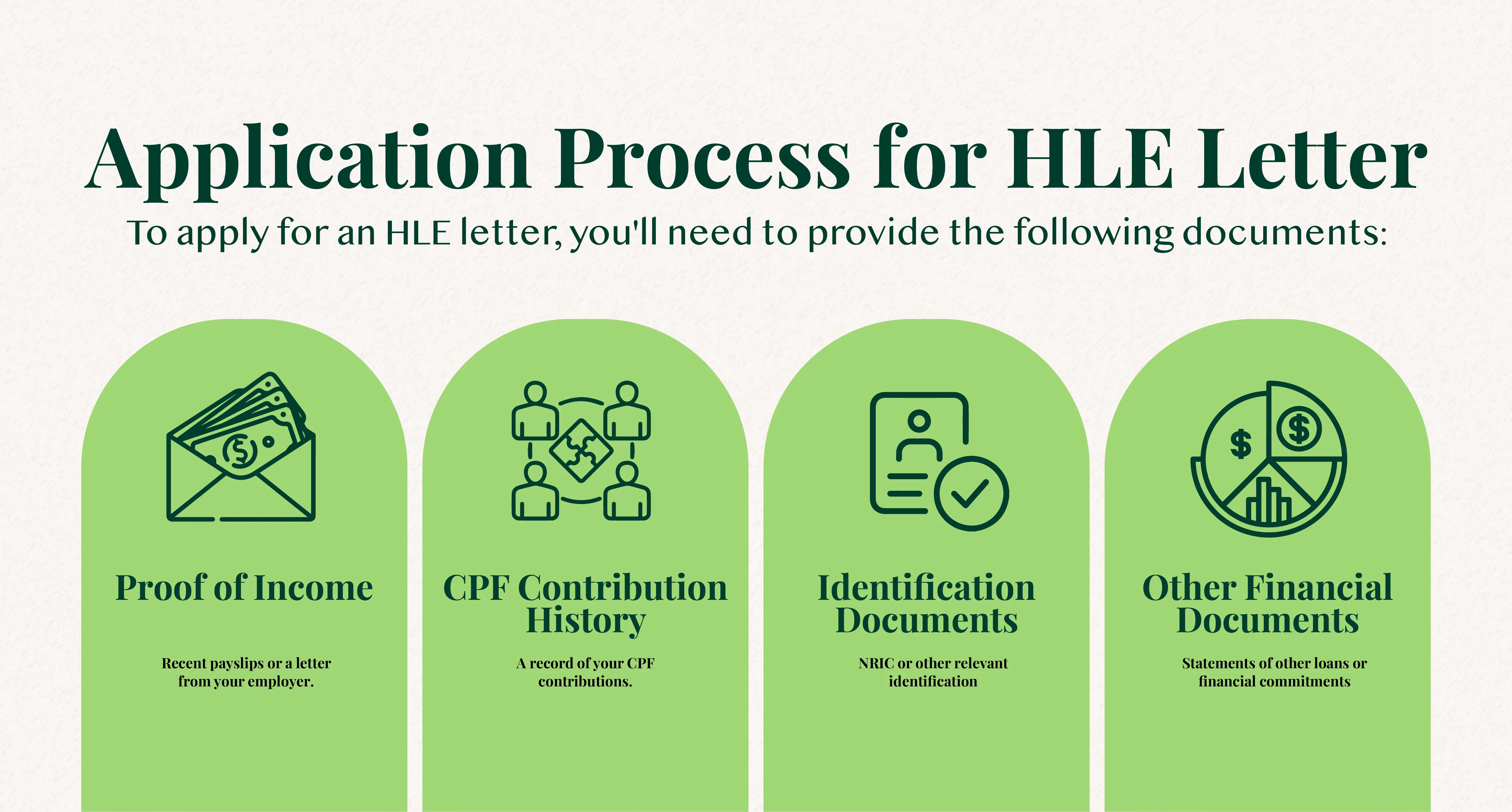

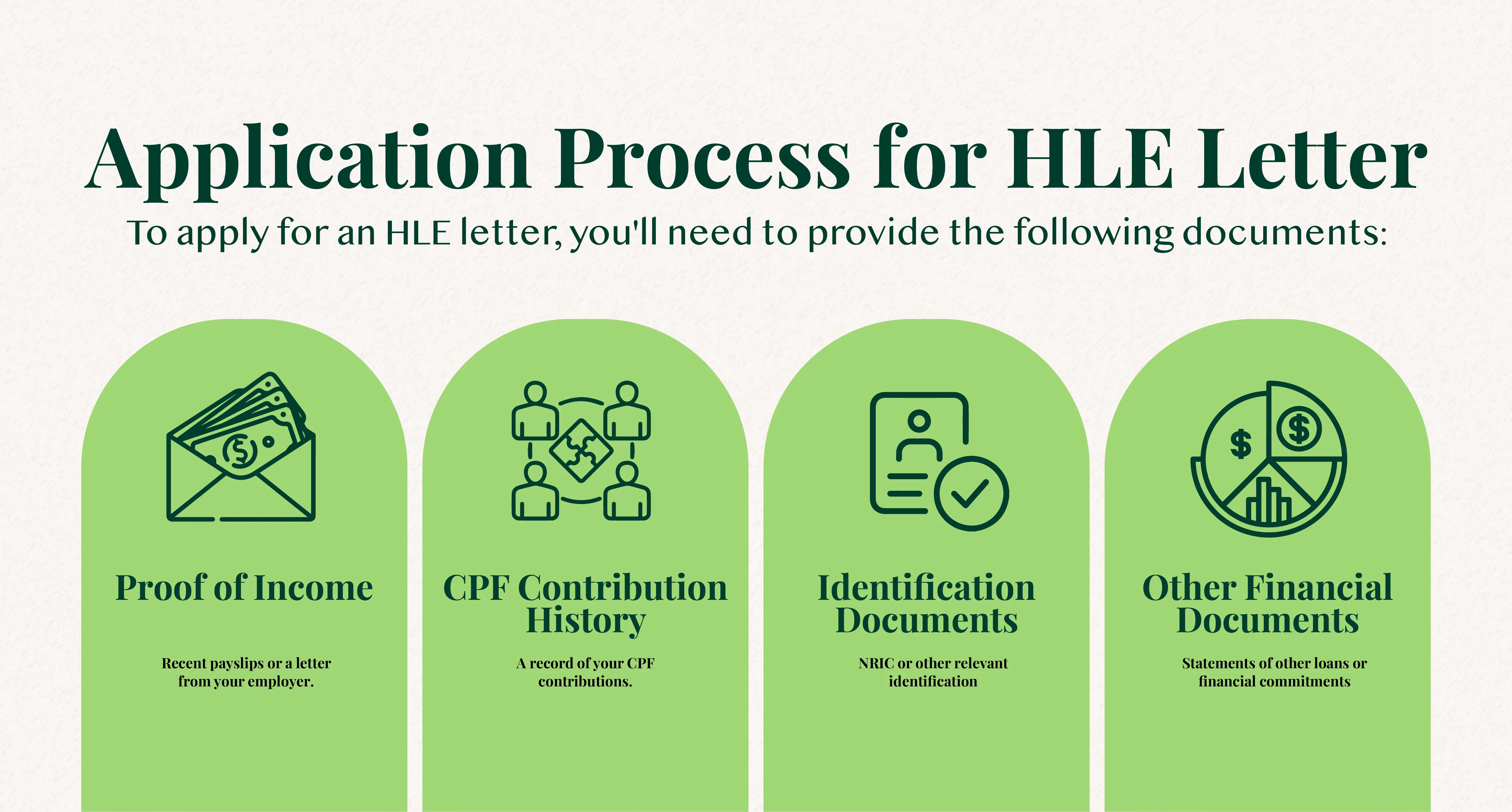

HDB Loan Eligibility (HLE) Letter

For HDB apartments, those going for a HDB loan can obtain a HDB Loan Eligibility (HLE) document. This document certifies you for a HDB loan and specifies the maximum amount you can secure. The HLE letter is valid for six months and must be valid at the time of your HDB apartment application.

Sources: Housing and Development Board

The application can be submitted online through the HDB website. Processing typically takes up to 14 days, after which you'll be informed of your eligibility and the loan amount.

If you are not eligible for a HDB Loan, you will have to look into acquiring a bank loan instead.

Securing a Bank Loan

Engaging with banks early to obtain an In-Principle Approval (IPA) is advisable. What’s an IPA? It is a bank's conditional approval indicating the loan amount you qualify for, based on an assessment of your finances.

Sources: PropertyGuru

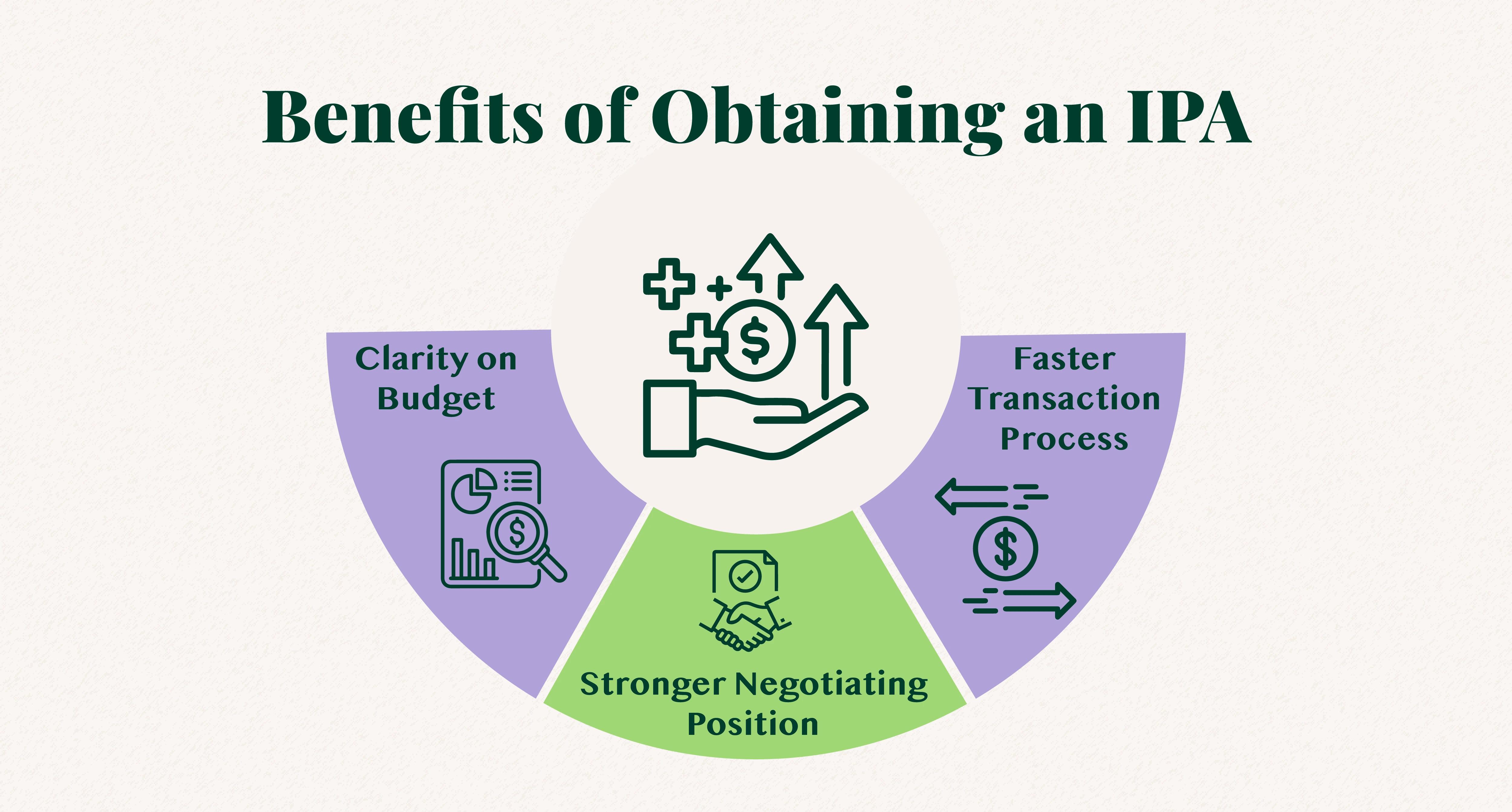

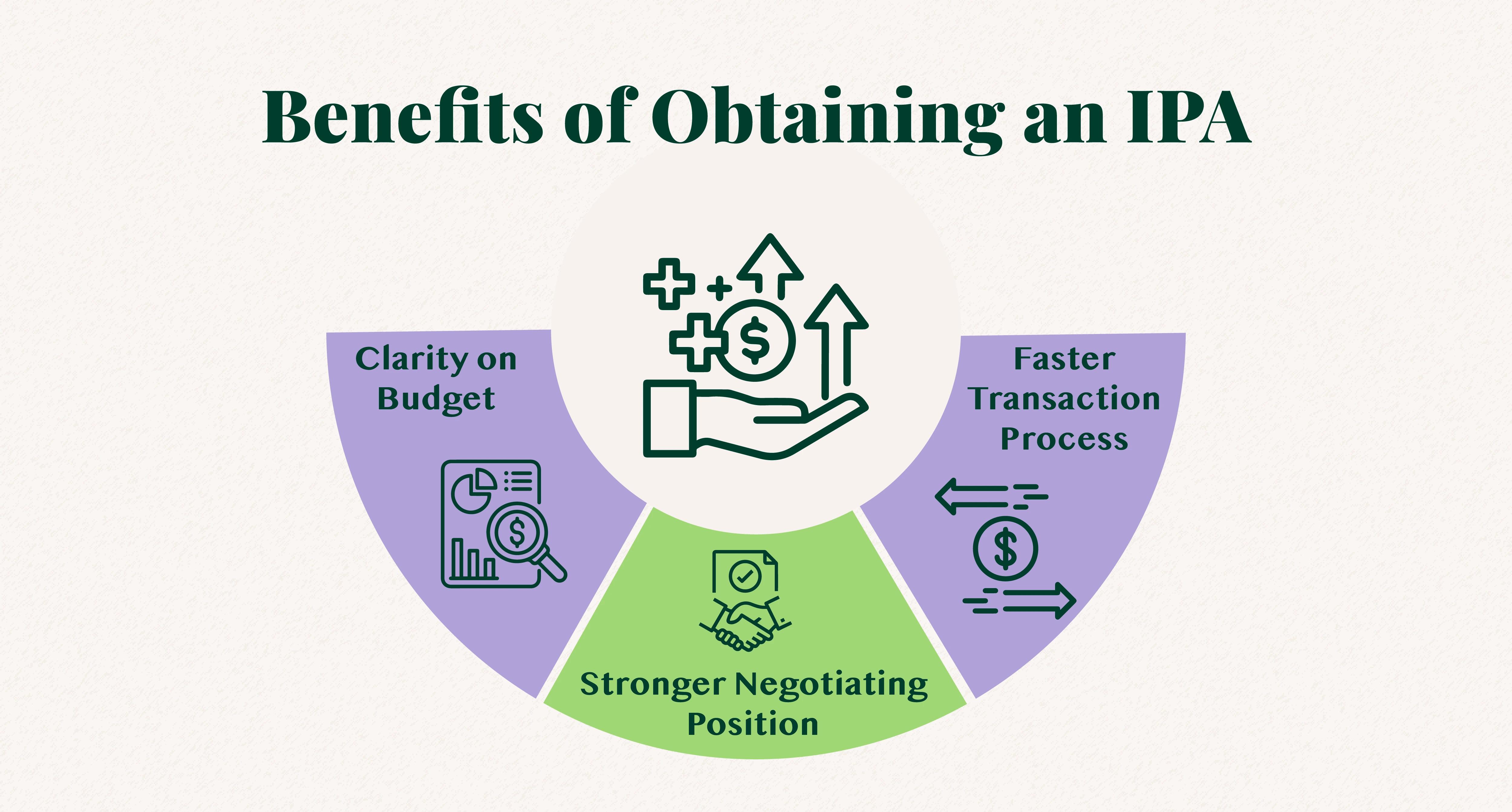

Benefits of Obtaining an IPA

Clarity on Budget: Knowing your loan eligibility helps in setting a realistic budget for your property search.

Stronger Negotiating Position: Sellers are more inclined to engage with buyers who have secured financing, as it indicates seriousness and financial readiness.

Faster Transaction Process: With financing preapproved, the subsequent steps in the buying process can proceed more swiftly.

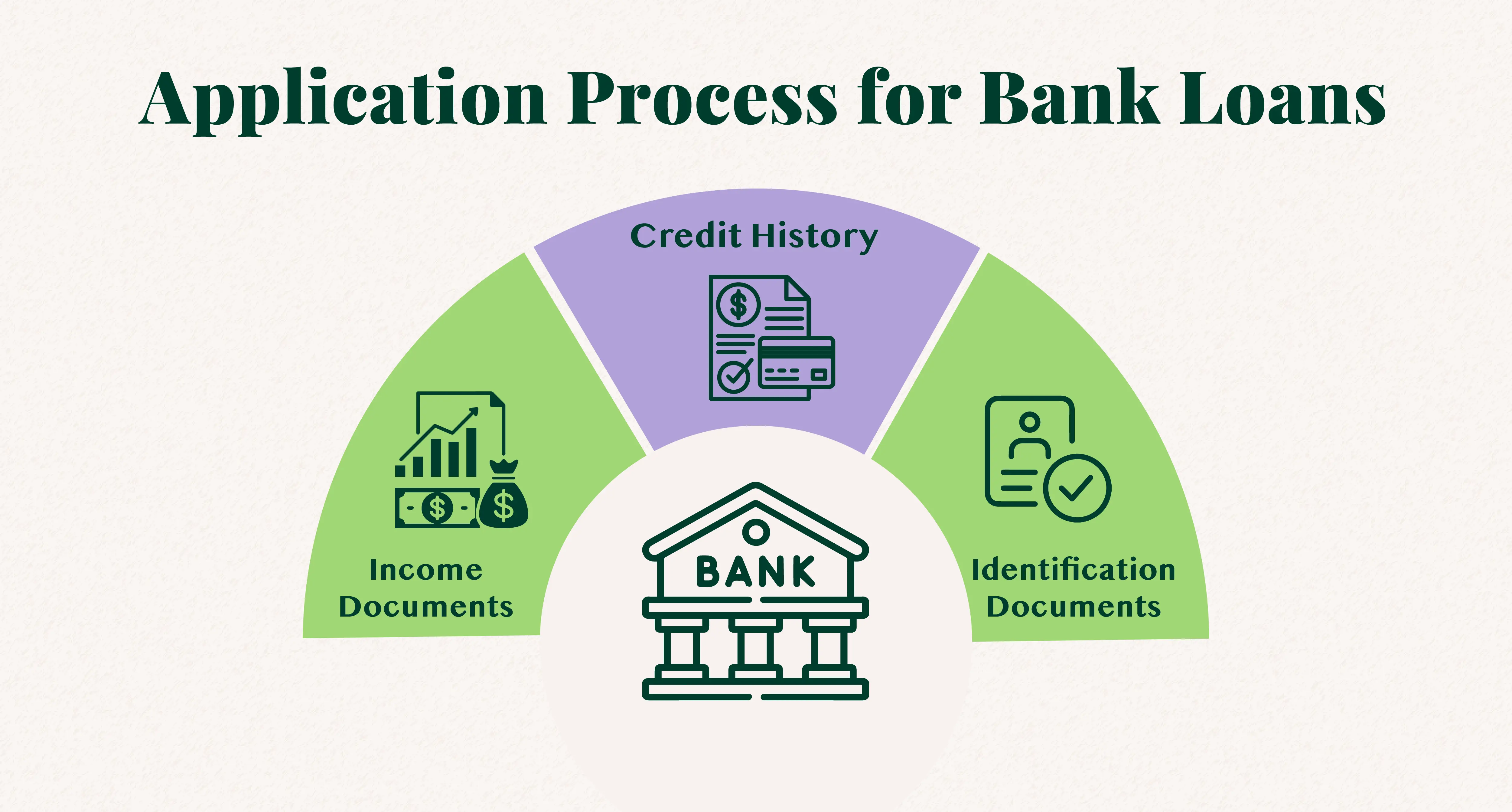

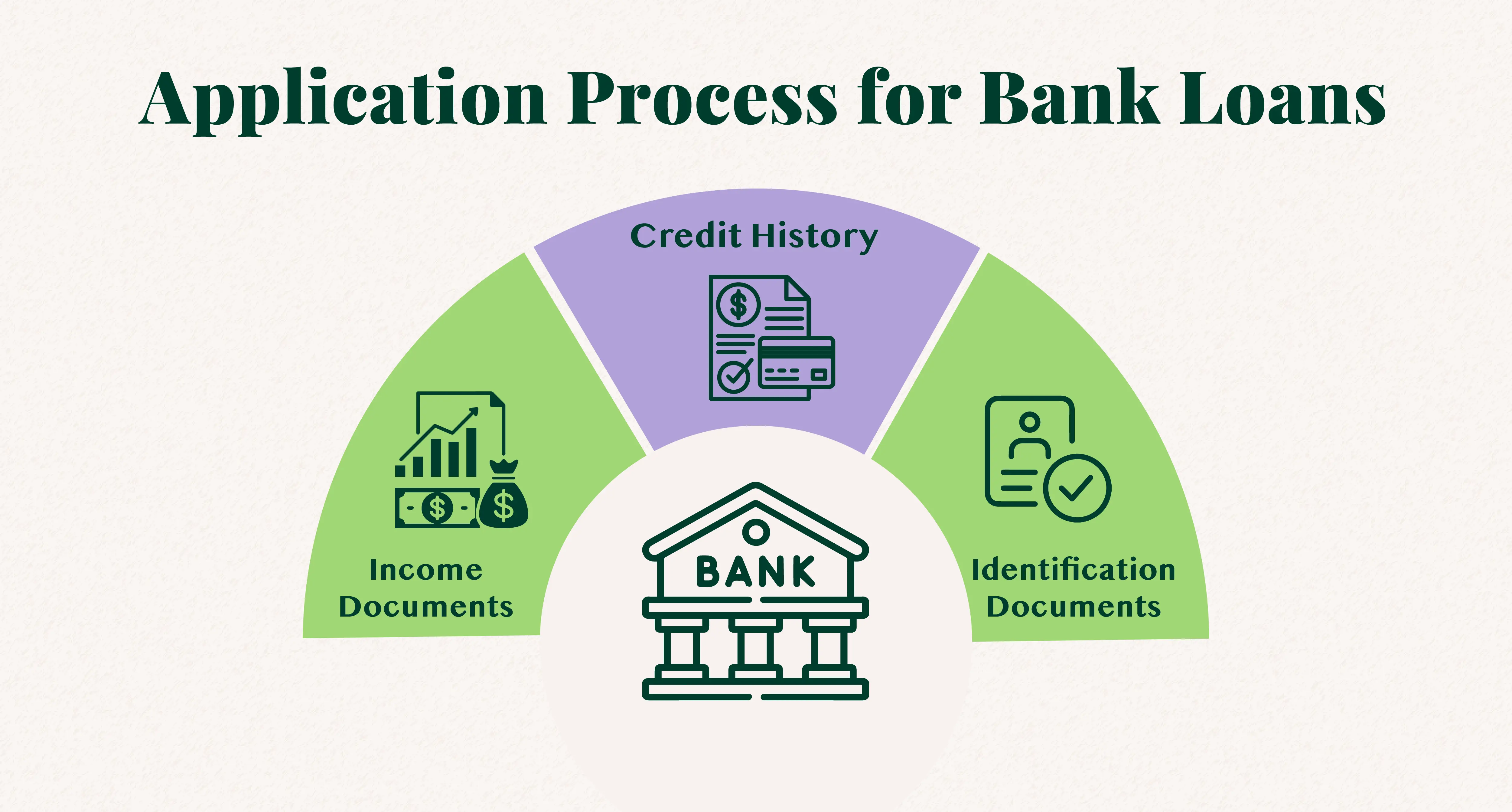

Application Process for Bank Loans

To apply for an IPA, you'll need to provide:

Income Documents: Recent payslips, CPF contribution history, and Notice of Assessment from IRAS.

Credit History: A credit report to assess your creditworthiness.

Identification Documents: NRIC or passport.

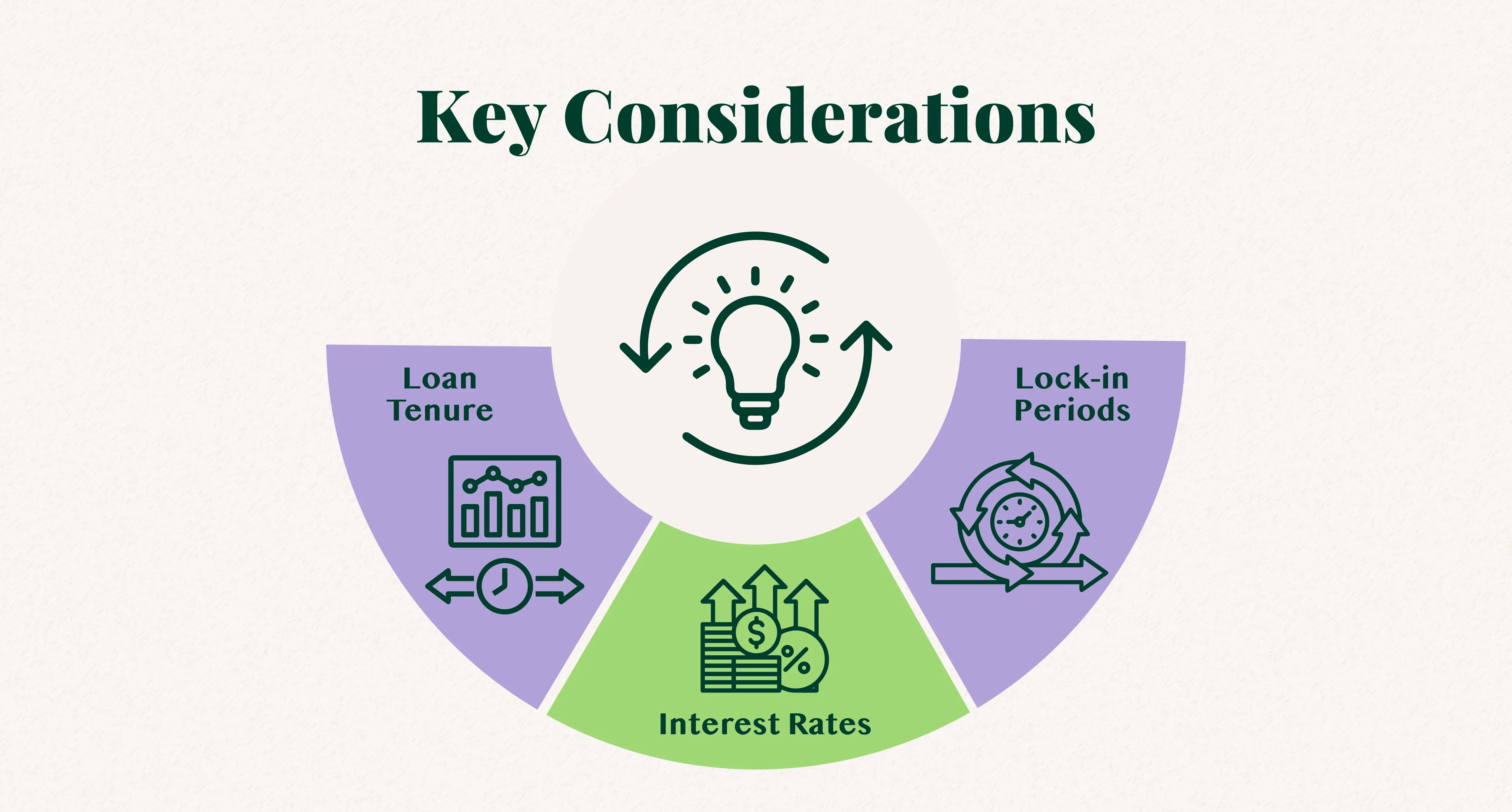

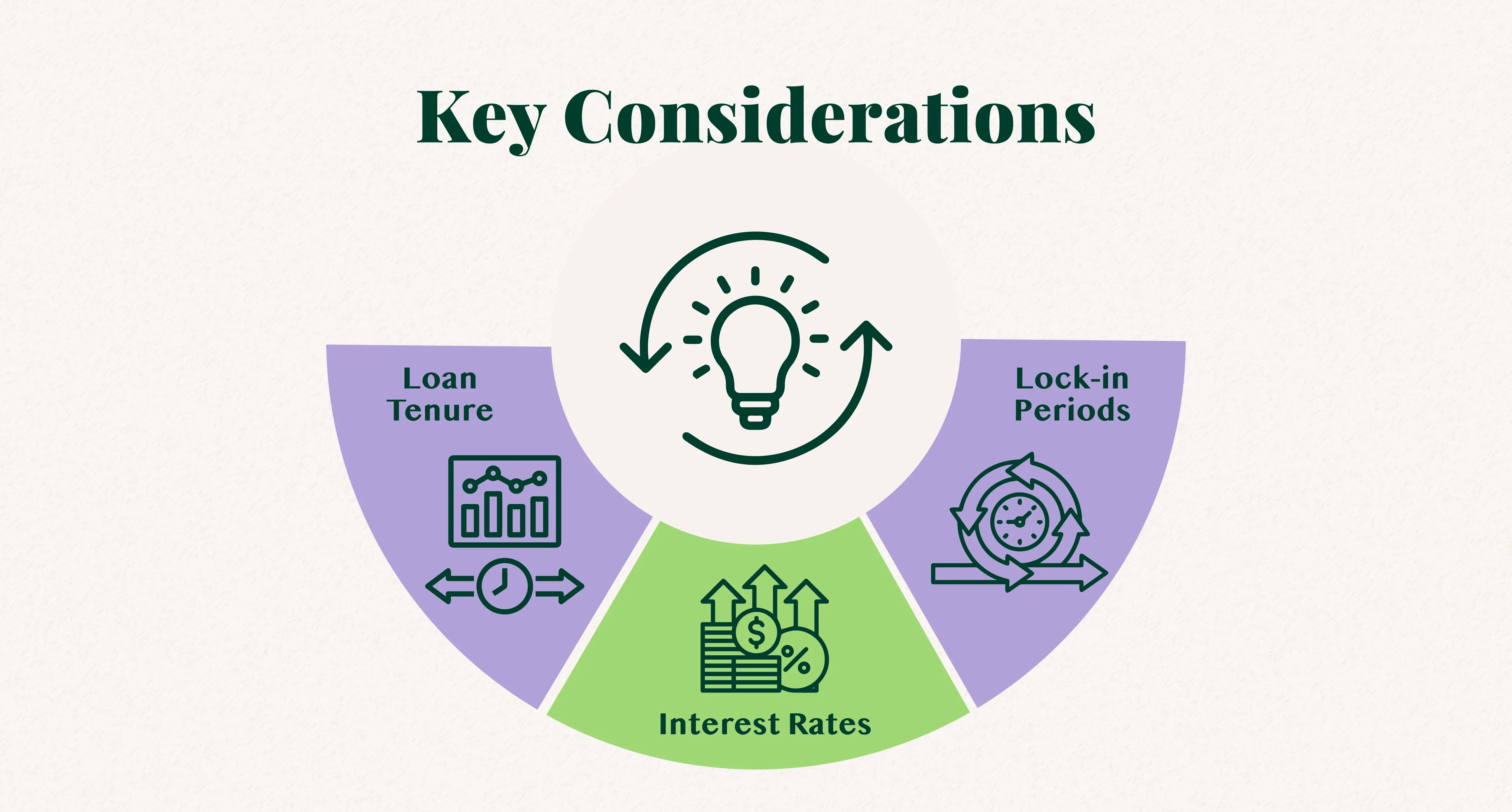

Key Considerations

Loan Tenure: The length of the loan can affect your monthly repayments and the total interest paid.

Interest Rates: Fixed vs. floating rates can impact your repayments differently.

Lock-in Periods: A time frame where you will have to pay a penalty should you wish to end the loan earlier than agreed. This can be if you want to pay off the loan in full, refinance your loan, or even sell your property.

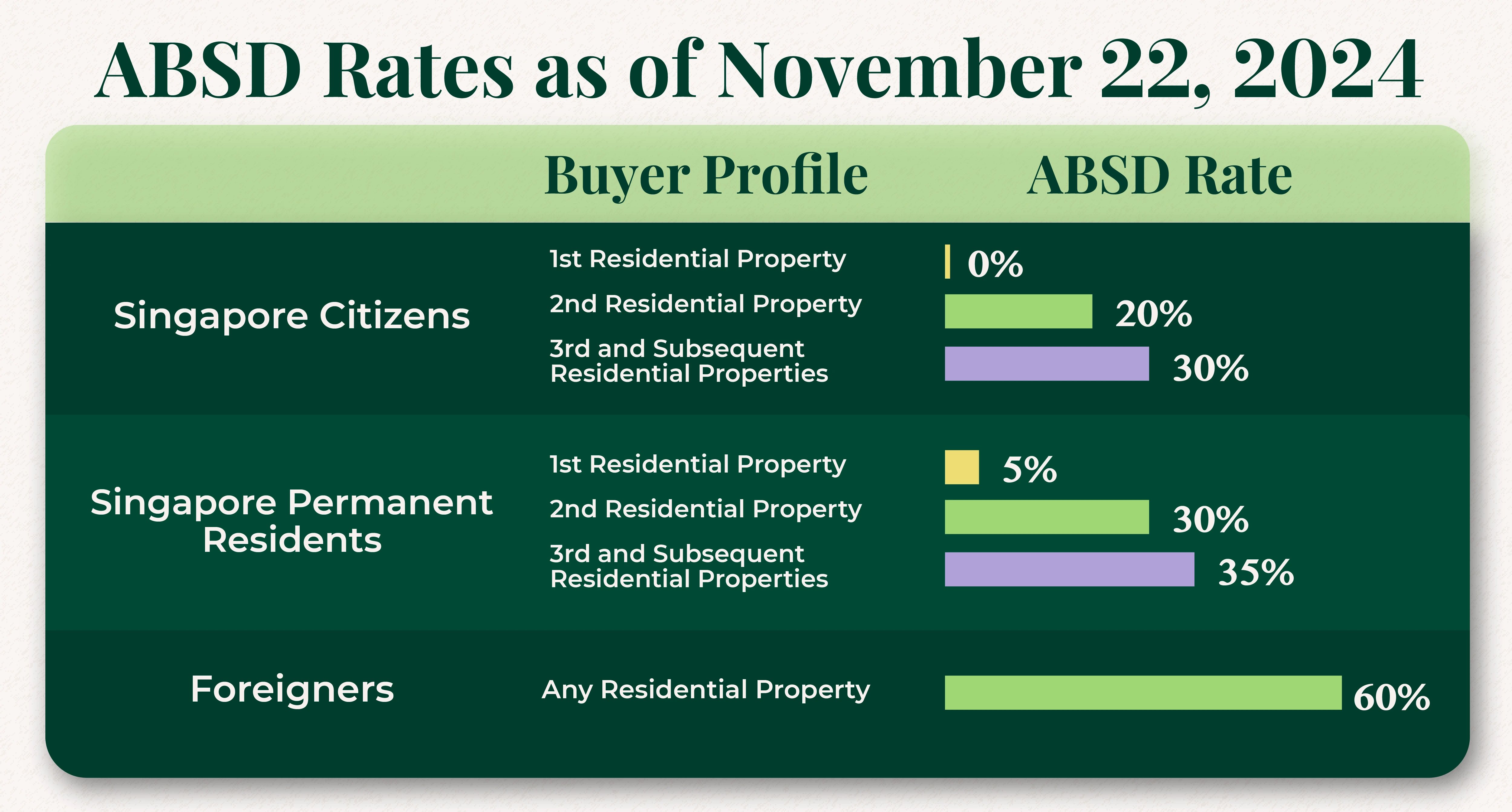

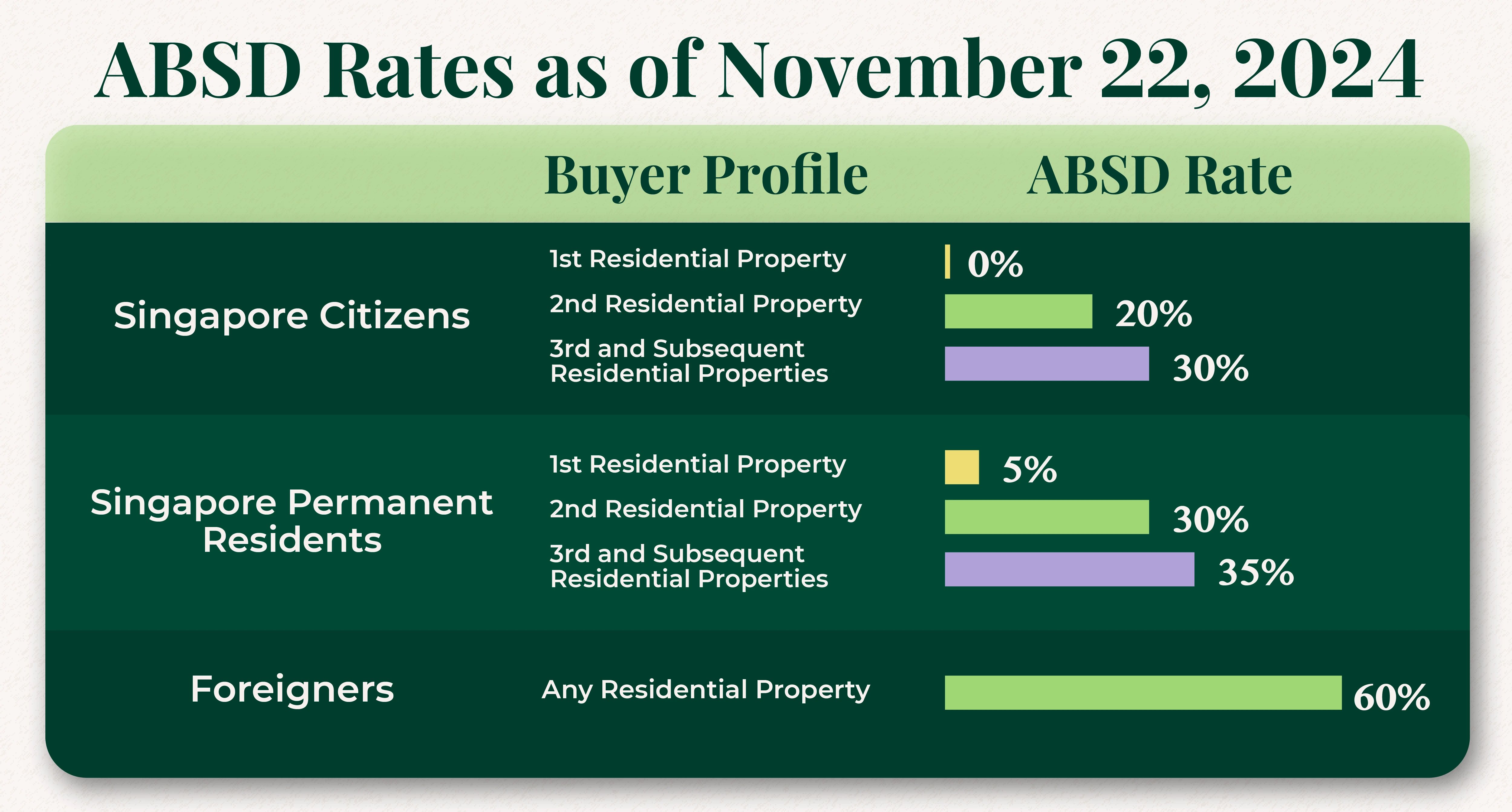

Step 4: Accounting for Additional Buyer’s Stamp Duty

When purchasing a residential property in Singapore, it is important to consider the Additional Buyer's Stamp Duty (ABSD). The ABSD rates vary based on the buyer's residency status and the number of properties owned.

ABSD Rates as of November 22, 2024:

Sources: Inland Revenue Authority of Singapore

Impact on Your Budget:

ABSD is calculated on the higher of the purchase price or market value of the property. For example, if a Singapore Citizen is purchasing a second property valued at $1,000,000, the ABSD payable would be 20% of $1,000,000, amounting to $200,000.

Exemptions and Remissions:

Certain scenarios may qualify for ABSD exemptions or remissions. For instance, married couples with at least one Singapore Citizen may be eligible for ABSD remission when purchasing their first matrimonial home, provided they sell their existing property within six months.

Sources: Inland Revenue Authority of Singapore

Step 5: Using Online Calculators for Clarity

There are online tools that allow you to estimate monthly mortgage repayments, total interest payable, and assess affordability based on your income, loan amount, and prevailing interest rates.

Recommended Online Calculators

Loan Experts' Calculators: Loan Experts offers a suite of calculators tailored for financial assessments:

Loan Eligibility: Determine your borrowing capacity based on current financial regulations.

Pledge / Show Fund: Assess the funds required to secure a loan.

Equity Loan: Calculate potential loan amounts against your property's equity.

Monthly Instalment: Estimate your monthly repayments for different loan amounts and tenures.

Buyer Stamp Duty: Compute the stamp duty payable on property purchases.

Seller Stamp Duty: Evaluate the stamp duty applicable upon selling a property.

HDB Loan Calculators: HDB offers calculators to estimate housing budgets and payment plans.

Bank Mortgage Calculators: Many banks in Singapore provide mortgage calculators on their websites. For instance, DBS Bank offers a comprehensive home loan calculator that estimates monthly repayments and assesses affordability.

Independent Financial Portals: Platforms like IQuadrant Mobile App feature mortgage calculators that allow you to compare loan packages across various banks, offering a broader perspective on available options.

By leveraging these online calculators, you can gain a clearer understanding of your finances, enabling you to plan ahead for your property journey.

Step 6: Creating a Financial Buffer

Maintaining a reserve fund of at least 6 months worth of expenses is advisable. This buffer serves as a safety net during unexpected events such as job loss, medical emergencies, or sudden financial burdens, allowing you to continue meeting your mortgage commitments without worry and stress.

Ongoing Homeownership Costs

In addition to mortgage repayments, homeowners should anticipate and budget for the following recurring expenses:

Property Tax: An annual tax levied on property owners, calculated based on the property's annual value.

Maintenance Fees:

HDB Flats: Subject to Service and Conservancy Charges (S&CC), which vary depending on the flat type and town council.

Private Properties: Condominiums and private estates usually charge monthly maintenance fees for the upkeep of common areas and facilities.

Utility Bills: Regular expenses for water, electricity, and gas consumption.

Home Insurance: Policies that cover potential damages to the property and its contents, providing financial protection against unforeseen events like fires or natural disasters.

Renovation and Repair Costs: Over time, properties may require renovations or repairs to maintain their condition and value. Allocating funds for such expenses is prudent.

Conclusion: Are You Financially Ready?

Assessing your financial readiness is the foundation of a successful home buying journey. By understanding your budget, taking advantage of CPF and cash savings, securing financing, and planning for additional expenses, you can move forward with confidence in purchasing the home of your dreams. Remember, being financially prepared is about ensuring long-term stability and comfort.

Start by evaluating your financial situation with the steps outlined above, and when you're ready, let us move on to helping you understand how to evaluate the value of the property you are looking at.

Must Read

Stay informed and inspired with the latest on real estate

Assessing Your Financial Readiness to Buy a Property in Singapore

Buying a house is a very big step in everyone’s life, and it requires careful financial planning to ensure that you are able to purchase the property you want. Here is everything you need to know to determine if you're financially ready to buy your dream home.

Step 1: Calculating Your Budget

Calculating your budget can help to set up a better expectation of the kind of house that you will be able to purchase according to your finances. Here’s a look at how to determine your budget.

Understanding the Total Debt Servicing Ratio (TDSR)

The Monetary Authority of Singapore introduced the Total Debt Servicing Ratio (TDSR) to promote financial prudence. Under this regulation, your total monthly debt obligations cannot exceed 55% of your gross monthly income. This rule applies to all property purchases, whether for HDB apartments, executive condominiums, private properties, or even commercial and industrial properties.

Sources: CPF Board

Example:

Gross monthly income: $5,000

Maximum monthly debt repayment under TDSR: $5,000 × 55% = $2,750

Any existing loan that you might have, such as a car loan with a monthly repayment of $750, will reduce your housing loan eligibility:

Remaining TDSR for housing loan: $2,750 - $750 = $2,000

Understanding the Mortgage Servicing Ratio (MSR)

Mortgage servicing ratio (MSR) refers to the portion of a borrower’s gross monthly income that goes towards repaying "all property loans". If you’re purchasing an HDB apartment or executive condominium, you can adhere to the Mortgage Servicing Ratio (MSR) instead of TDSR. Under MSR, a cap of 30% of your gross monthly income can be used for your monthly housing loan repayments.

Sources: DollarsAndSense

Considering Additional Costs

Your budget doesn’t just end with the property’s purchasing price. It’s also important to account for any other additional costs, which can significantly impact your affordability:

Downpayment: The amount that a property buyer pays up front when purchasing a property. It is usually a percentage of the purchase price of the property.

Buyer’s Stamp Duty (BSD): The BSD is a tiered tax based on the property’s purchase price.

Sources: Inland Revenue Authority of Singapore Buyer Stamp Duty, Inland Revenue Authority of Singapore Additional Buyer Stamp Duty and DBS

Set Realistic Expectations

Once you’ve calculated your TDSR and MSR limits and factored in additional costs, you’ll have a clearer picture of the property you can afford. For instance:

If your TDSR allows for a maximum loan of $800,000 and you have $200,000 in CPF and cash savings for the down payment, your expected budget is $1,000,000.

Consider leaving room for other expenses, such as renovations, home styling or repairs, by purchasing a property slightly below your expected budget.

How to Use Online Tools to Simplify Budgeting

Various online calculators, such as the Loan Expert Calculator and IQuadrant Mortgage Calculator, can help you determine your loan eligibility and monthly repayments. These tools can provide quick and accurate estimates, saving you time and effort.

Step 2: Leveraging CPF and Cash Savings

The Central Provident Fund (CPF) can offer substantial support in financing a property purchase. However, it is important to understand both its capabilities and limitations to ensure a smooth property buying journey.

Down Payment: CPF OA savings can fully or partially cover down payments, such as for resale HDB apartments with an HDB loan.

Monthly Mortgage Repayments: Use CPF OA funds for housing loan installments, reducing monthly expenses.

Stamp Duties: CPF savings can pay stamp duties, including BSD and ABSD (if applicable).

Sources: Housing and Development Board and CPF Board

Limitations of CPF Usage

While CPF provides significant assistance, it doesn't cover all expenses. Bank loans still require a portion of the down payment to be made in cash. When financing through a bank, at least 5% of the property purchase price must be paid in cash, with an additional 20% that can be covered using any combination of CPF OA savings or cash.

Sources: SingSaver

Importance of Cash Savings

Beyond the initial purchase, several expenses also require cash payments:

CPF Withdrawal Limits and Housing Valuation

Be aware that CPF usage is also subjected to withdrawal limits tied to the property's Valuation Limit (VL) and Withdrawal Limit (WL):

Valuation Limit (VL): The lower of the purchase price or the market valuation of the property at the time of purchase.

Withdrawal Limit (WL): Capped at 120% of the Valuation Limit. Exceeding this amount may require setting aside funds in your CPF Retirement Account (RA).

Impact of Property Lease on CPF Usage

The remaining lease of the property plays a significant role in determining the extent of CPF usage:

Lease Covers Youngest Buyer Until Age 95: If the property's remaining lease can cover the youngest buyer until at least the age of 95, you can use your CPF savings up to the property VL.

Lease Does Not Cover Youngest Buyer Until Age 95: If the remaining lease is insufficient to cover the youngest buyer until age 95, the maximum amount of CPF savings that can be used is prorated. This amount is based on how much the remaining lease covers the youngest buyer up to age 95. This measure ensures that buyers retain adequate CPF savings for future housing needs when their lease ends.

Sources: CPF

Key Considerations

Minimum Lease Requirement: CPF savings cannot be used if the property's remaining lease is less than 20 years.

Sources: Ministry of National Development

Setting Aside Retirement Sum: To utilize CPF savings beyond the VL, up to the WL, you must set aside the prevailing funds in your RA.

Sources: Dollars and Sense

Regular Updates: CPF policies are subject to periodic updates. It's advisable to consult the CPF Board's official website or contact them directly for the most current information.

Balancing CPF and Cash

While CPF does ease the financial burden of buying a home, do be mindful that it is not a substitute for cash liquidity. Over-reliance on CPF can leave you vulnerable to expenses it doesn't cover. Striking the right balance between CPF usage and cash reserves ensures you're financially prepared for both expected and unexpected costs.

Step 3: Securing Financing

Securing financing is the next step in the home buying process in Singapore. Understanding the available loan options and their requirements ensures a smoother transaction and helps you make informed decisions.

HDB Loan Eligibility (HLE) Letter

For HDB apartments, those going for a HDB loan can obtain a HDB Loan Eligibility (HLE) document. This document certifies you for a HDB loan and specifies the maximum amount you can secure. The HLE letter is valid for six months and must be valid at the time of your HDB apartment application.

Sources: Housing and Development Board

The application can be submitted online through the HDB website. Processing typically takes up to 14 days, after which you'll be informed of your eligibility and the loan amount.

If you are not eligible for a HDB Loan, you will have to look into acquiring a bank loan instead.

Securing a Bank Loan

Engaging with banks early to obtain an In-Principle Approval (IPA) is advisable. What’s an IPA? It is a bank's conditional approval indicating the loan amount you qualify for, based on an assessment of your finances.

Sources: PropertyGuru

Benefits of Obtaining an IPA

Clarity on Budget: Knowing your loan eligibility helps in setting a realistic budget for your property search.

Stronger Negotiating Position: Sellers are more inclined to engage with buyers who have secured financing, as it indicates seriousness and financial readiness.

Faster Transaction Process: With financing preapproved, the subsequent steps in the buying process can proceed more swiftly.

Application Process for Bank Loans

To apply for an IPA, you'll need to provide:

Income Documents: Recent payslips, CPF contribution history, and Notice of Assessment from IRAS.

Credit History: A credit report to assess your creditworthiness.

Identification Documents: NRIC or passport.

Key Considerations

Loan Tenure: The length of the loan can affect your monthly repayments and the total interest paid.

Interest Rates: Fixed vs. floating rates can impact your repayments differently.

Lock-in Periods: A time frame where you will have to pay a penalty should you wish to end the loan earlier than agreed. This can be if you want to pay off the loan in full, refinance your loan, or even sell your property.

Step 4: Accounting for Additional Buyer’s Stamp Duty

When purchasing a residential property in Singapore, it is important to consider the Additional Buyer's Stamp Duty (ABSD). The ABSD rates vary based on the buyer's residency status and the number of properties owned.

ABSD Rates as of November 22, 2024:

Sources: Inland Revenue Authority of Singapore

Impact on Your Budget:

ABSD is calculated on the higher of the purchase price or market value of the property. For example, if a Singapore Citizen is purchasing a second property valued at $1,000,000, the ABSD payable would be 20% of $1,000,000, amounting to $200,000.

Exemptions and Remissions:

Certain scenarios may qualify for ABSD exemptions or remissions. For instance, married couples with at least one Singapore Citizen may be eligible for ABSD remission when purchasing their first matrimonial home, provided they sell their existing property within six months.

Sources: Inland Revenue Authority of Singapore

Step 5: Using Online Calculators for Clarity

There are online tools that allow you to estimate monthly mortgage repayments, total interest payable, and assess affordability based on your income, loan amount, and prevailing interest rates.

Recommended Online Calculators

Loan Experts' Calculators: Loan Experts offers a suite of calculators tailored for financial assessments:

Loan Eligibility: Determine your borrowing capacity based on current financial regulations.

Pledge / Show Fund: Assess the funds required to secure a loan.

Equity Loan: Calculate potential loan amounts against your property's equity.

Monthly Instalment: Estimate your monthly repayments for different loan amounts and tenures.

Buyer Stamp Duty: Compute the stamp duty payable on property purchases.

Seller Stamp Duty: Evaluate the stamp duty applicable upon selling a property.

HDB Loan Calculators: HDB offers calculators to estimate housing budgets and payment plans.

Bank Mortgage Calculators: Many banks in Singapore provide mortgage calculators on their websites. For instance, DBS Bank offers a comprehensive home loan calculator that estimates monthly repayments and assesses affordability.

Independent Financial Portals: Platforms like IQuadrant Mobile App feature mortgage calculators that allow you to compare loan packages across various banks, offering a broader perspective on available options.

By leveraging these online calculators, you can gain a clearer understanding of your finances, enabling you to plan ahead for your property journey.

Step 6: Creating a Financial Buffer

Maintaining a reserve fund of at least 6 months worth of expenses is advisable. This buffer serves as a safety net during unexpected events such as job loss, medical emergencies, or sudden financial burdens, allowing you to continue meeting your mortgage commitments without worry and stress.

Ongoing Homeownership Costs

In addition to mortgage repayments, homeowners should anticipate and budget for the following recurring expenses:

Property Tax: An annual tax levied on property owners, calculated based on the property's annual value.

Maintenance Fees:

HDB Flats: Subject to Service and Conservancy Charges (S&CC), which vary depending on the flat type and town council.

Private Properties: Condominiums and private estates usually charge monthly maintenance fees for the upkeep of common areas and facilities.

Utility Bills: Regular expenses for water, electricity, and gas consumption.

Home Insurance: Policies that cover potential damages to the property and its contents, providing financial protection against unforeseen events like fires or natural disasters.

Renovation and Repair Costs: Over time, properties may require renovations or repairs to maintain their condition and value. Allocating funds for such expenses is prudent.

Conclusion: Are You Financially Ready?

Assessing your financial readiness is the foundation of a successful home buying journey. By understanding your budget, taking advantage of CPF and cash savings, securing financing, and planning for additional expenses, you can move forward with confidence in purchasing the home of your dreams. Remember, being financially prepared is about ensuring long-term stability and comfort.

Start by evaluating your financial situation with the steps outlined above, and when you're ready, let us move on to helping you understand how to evaluate the value of the property you are looking at.

Discover local real estate gems and insightful properties reviews

Check out our local Youtube Channel

Hello, How Can We Help?

Got any questions for us? Let us know what you need answers to and we'll be in touch with you

By submitting, you agree to receive future marketing materials from Crestbrick Pte Ltd. Your personal information will be used according to our privacy policy. You may also drop us an email at [email protected].